Have you ever checked your credit card statement and noticed a charge labeled “VIOC” that you didn’t recognize? If “yes” then What Is VIOC On My Credit Card? This can be a cause for concern, as it’s not immediately clear what this charge represents.

In this article, I’ll dive into what VIOC means, what types of charges might fall under this label, and answer some questions to help you better understand this mysterious charge on your credit card statement.

Table of Contents

What Is VIOC On My Credit Card?

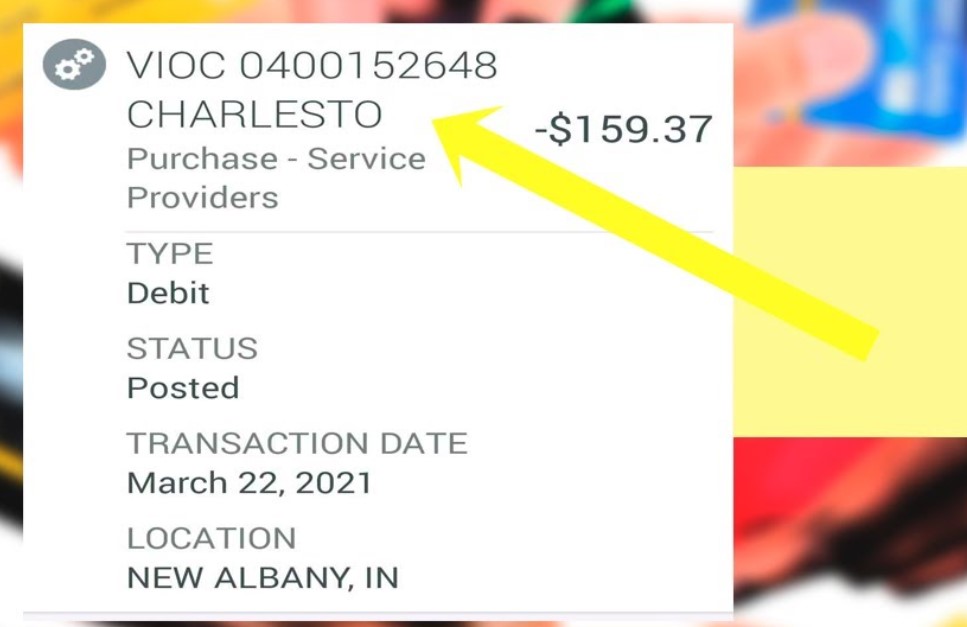

VIOC is an acronym that stands for “Vehicle Inspection and Oil Change.” If you see a charge labeled VIOC on your credit card statement, it most likely means that you visited a Valvoline Instant Oil Change location and had some work done on your vehicle. This could include an oil change, fluid top-off, or a vehicle inspection.

Valvoline Instant Oil Change is a chain of auto maintenance shops that specialize in oil changes and other quick automotive services. With over 1,000 locations across the United States, it’s possible that you visited a Valvoline location without realizing it.

What Is The VIOC Charge On Your Bank Statement?

If you see a VIOC charge on your bank statement, it typically refers to a transaction made at a Valvoline Instant Oil Change location. Valvoline Instant Oil Change is a chain of auto maintenance shops that specialize in oil changes and other quick automotive services.

So if you recently visited a Valvoline location and had some work done on your vehicle, such as an oil change or a vehicle inspection, it’s likely that the VIOC charge on your bank statement is related to that transaction.

However, it’s always important to investigate any charges that you don’t recognize to ensure that they are legitimate. If you have any concerns about a VIOC charge on your bank statement, you can contact your bank or credit card issuer to get more information.

What Types Of Charges Fall Under VIOC?

While the most common type of charge that falls under the VIOC label is for automotive services performed at a Valvoline location, there are a few other charges that could be labeled as VIOC on your credit card statement. Here are some examples:

- Some Valvoline locations offer additional services beyond oil changes and vehicle inspections, such as tire rotations or air filter replacements. These charges may also fall under the VIOC label.

- If you purchased automotive products or services from a Valvoline website, such as motor oil or windshield wipers, the charge may appear as VIOC on your statement.

- In some cases, fraudulent charges may be labeled as VIOC in an attempt to mask their true nature. If you don’t recognize a VIOC charge on your statement, be sure to investigate it thoroughly to ensure that it’s legitimate.

How To Handle The VIOC Bank Charge?

If you have a VIOC bank charge that you don’t recognize or have concerns about, there are a few steps you can take to handle it:

Investigate The Charge

First, review your records to see if you made any purchases or received any services that might be related to a VIOC charge. If you recently visited a Valvoline Instant Oil Change location or made a purchase on their website, the charge might be legitimate.

Contact Valvoline

If you can’t remember the transaction or you have concerns about the charge, contact Valvoline directly. They can provide more information about the transaction and help you understand why the charge appears on your bank statement.

Contact Your Bank Or Credit Card Issuer

If you still have concerns after speaking with Valvoline, you can contact your bank or credit card issuer to dispute the charge. They will investigate the charge and work with you to resolve the issue.

Keep Records

Be sure to keep records of all communications, receipts, and any other documentation related to the charge. This will be helpful if you need to provide evidence during the dispute process.

By taking these steps, you can handle a VIOC bank charge and ensure that your finances are secure.

Conclusion

If you see a VIOC charge on your credit card statement, it’s most likely related to automotive services performed at a Valvoline Instant Oil Change location. However, it’s important to investigate any charges that you don’t recognize to ensure that they are legitimate.

By understanding what VIOC means and what types of charges might fall under this label, you can stay informed and make informed decisions about your finances. That concludes What Is VIOC On My Credit Card?

Frequently Asked Questions

Why does my credit card statement show a VIOC charge?

If you visited a Valvoline Instant Oil Change location or purchased automotive products or services from their website, the charge may appear as VIOC on your statement.

How can I dispute a VIOC charge that I don’t recognize?

Contact your credit card issuer immediately to report the charge as fraudulent. They will investigate the charge and work with you to resolve the issue.

Are there any other charges that could be labeled as VIOC on my credit card statement?

Yes, charges for additional services performed at Valvoline locations or purchases made on their website may also appear as VIOC.

Can I get a receipt or proof of purchase for a VIOC charge?

Yes, if you visited a Valvoline location, you should have received a receipt at the time of service. If you made a purchase on their website, you should receive a confirmation email with details about the transaction.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.