When it comes to What Bank Is PayPal On Plaid? The question often arises due to the integration of PayPal with Plaid’s financial services. This article aims to shed light on how PayPal interacts with Plaid and what role banks play in this equation.

What Bank Is PayPal On Plaid?

PayPal does not explicitly state which bank it uses on Plaid. However, Plaid serves as a financial data aggregator, connecting PayPal to various banks to facilitate transactions.

How Does PayPal Use Plaid?

PayPal uses Plaid as an intermediary to facilitate secure and efficient financial transactions. Here’s a more detailed explanation:

Role of Plaid in PayPal Transactions

When a user wants to link their bank account to their PayPal account, Plaid comes into play as a financial data aggregator. It acts as a bridge between PayPal and the user’s bank, allowing for quick and secure verification of bank account information.

Process of Account Verification

Once a user chooses to link a bank account, Plaid provides a user interface where the user can select their bank and enter their online banking credentials. Plaid then verifies the account’s existence and its balance in real-time, providing this verified information back to PayPal.

Facilitating Transactions

After successful verification, the user’s bank account is linked to their PayPal account. Now, whenever the user wants to make a transaction using PayPal, Plaid ensures that the necessary financial data is securely transmitted between the bank and PayPal.

This enables users to make purchases, send money, and perform other financial transactions through PayPal without having to enter their bank details every time.

Enhanced Security

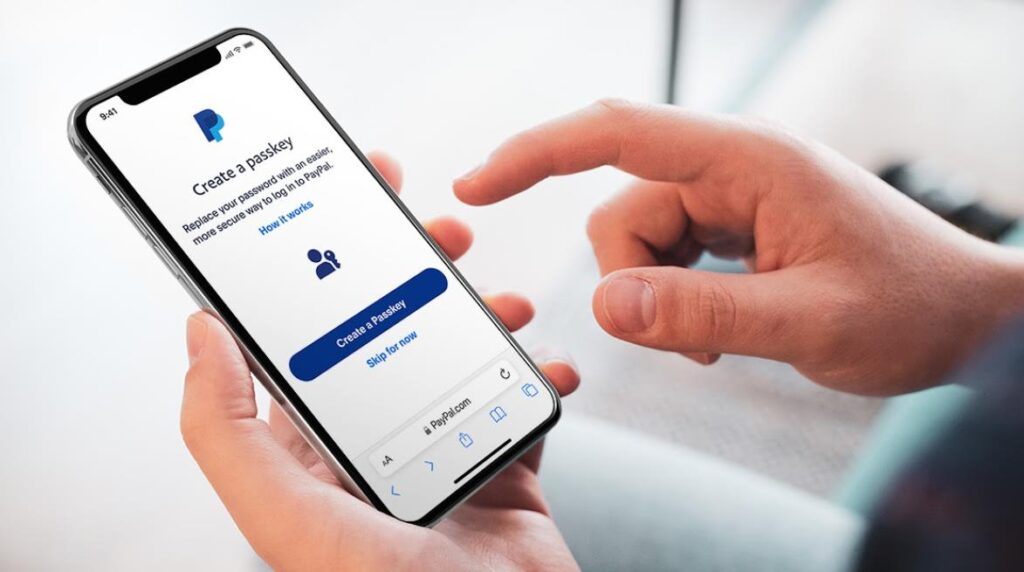

Plaid uses multiple layers of security measures, including advanced encryption algorithms and multi-factor authentication, to ensure the safety of the user’s financial data. This adds an extra layer of security to PayPal transactions, making them more secure than traditional methods of online payment.

Benefits for PayPal Users

- Seamless transactions

- Quick account verification

- Enhanced security

By acting as an intermediary, Plaid simplifies the process of bank account verification and enhances the security of financial transactions made via PayPal.

Features Of Plaid When Using With PayPal

Security Measures: How Does Plaid Ensures Security?

Plaid uses multiple layers of security measures, such as encryption and multi-factor authentication, to ensure that transactions are secure.

What This Means for PayPal Users

PayPal users can rest assured that their financial data is safe when connecting their bank accounts via Plaid.

The Technical Aspect: API Integration

Plaid provides APIs that make it easier for PayPal to integrate its services, thus facilitating a seamless user experience.

Data Aggregation

Plaid aggregates financial data from various sources, making it easier for PayPal to offer a range of services to its users.

User Experience: Ease of Use

The integration of Plaid into PayPal’s services makes it incredibly easy for users to link their bank accounts.

User Feedback

Most users find the Plaid-PayPal integration to be efficient and user-friendly.

Market Impact: Competitive Advantage

The PayPal-Plaid partnership gives PayPal a competitive edge in the market, especially in terms of user experience and security.

Future Prospects

The partnership is likely to evolve, offering more features and benefits to users in the future.

Regulatory Compliance: How Plaid and PayPal Meet Regulations?

Both Plaid and PayPal are subject to financial regulations, ensuring that they comply with laws related to user data and financial transactions. This adds an extra layer of trust for users.

GDPR and Other Regulations

Being global companies, both PayPal and Plaid adhere to international regulations like GDPR, which governs data protection and privacy.

Global Reach: Plaid’s Network

Plaid connects with over 12,000 financial institutions worldwide, expanding the reach of PayPal’s services.

PayPal’s Global Presence

PayPal operates in more than 200 countries, and its integration with Plaid further strengthens its global footprint.

Cost and Fees: Plaid’s Pricing Model

Plaid offers different pricing tiers, including some that are particularly beneficial for startups and small businesses.

How This Affects PayPal Users?

PayPal users should be aware that while PayPal itself may not charge extra fees for bank connectivity, Plaid might have its own separate fees.

Developer Ecosystem: Plaid’s API-first Network

Plaid provides an API-first network that allows for easy integration, not just with PayPal but also with other financial apps.

PayPal’s Developer Resources

PayPal also offers extensive documentation and APIs, making it easier for businesses to integrate PayPal services.

Customer Support: Plaid’s Customer Service

Plaid offers robust customer support, including a comprehensive FAQ section and direct support channels.

PayPal’s Customer Support

PayPal is known for its customer service, including 24/7 support and multiple channels for customer queries.

Future Innovations

What’s Next for Plaid?

Plaid is continuously innovating, with plans to expand its services and offer more features.

What’s Next for PayPal?

PayPal is also not far behind in innovation, with plans to integrate more services and features, especially in the mobile payments sector.

Can I Connect PayPal Through Plaid?

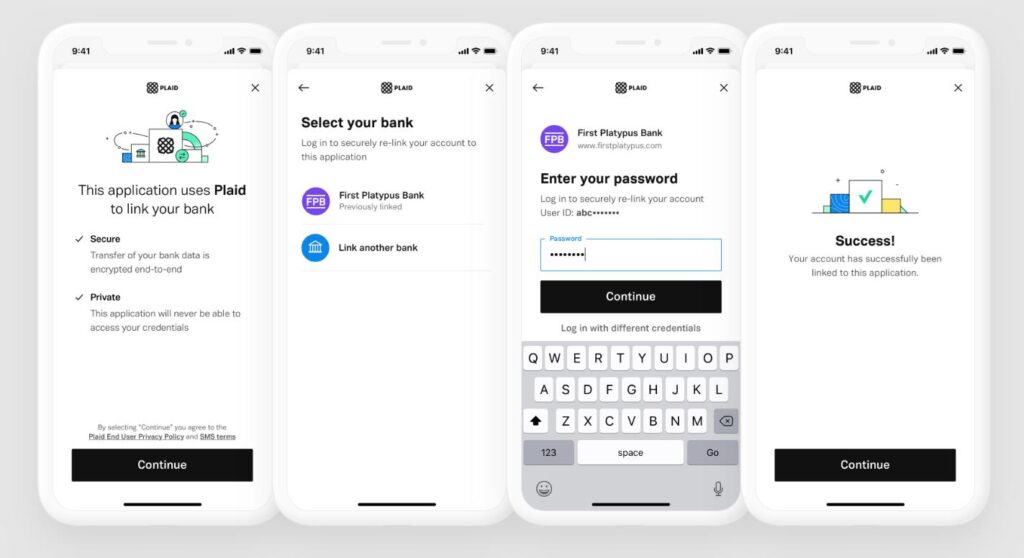

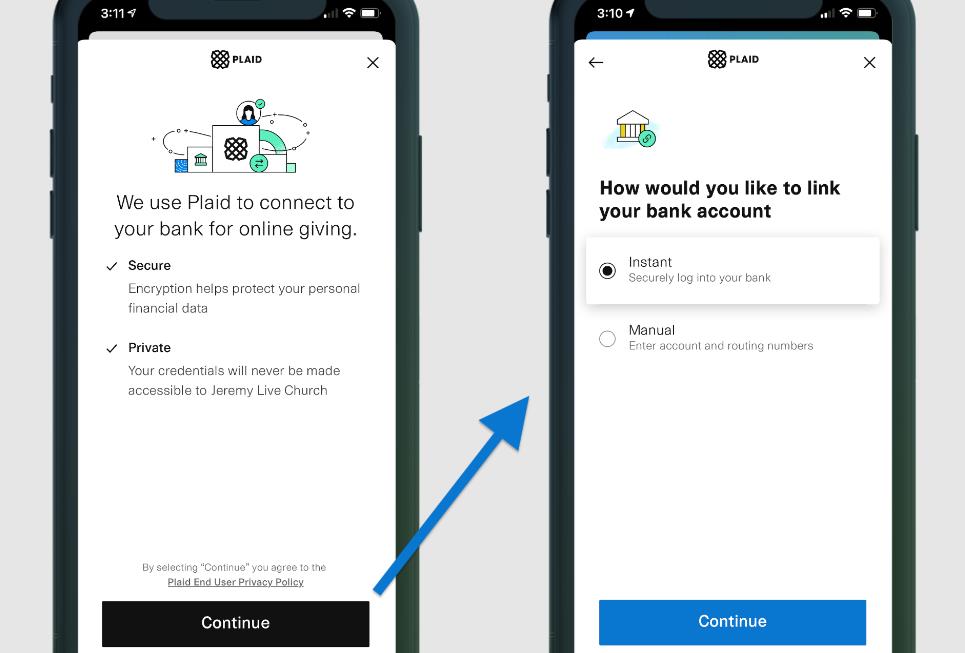

Yes, you can connect your PayPal account through Plaid. Plaid serves as an intermediary that facilitates the secure linking of your bank account to your PayPal account. When you opt to link a bank account on PayPal, Plaid’s interface pops up, allowing you to choose your bank and enter your online banking credentials.

Plaid then verifies this information in real time and securely transmits it back to PayPal. This not only streamlines the account verification process but also adds an extra layer of security to your transactions.

How To Connect PayPal And Plaid?

Connecting your PayPal account to Plaid is a straightforward process. Here are the steps to do it:

- Log in to PayPal: First, log in to your PayPal account.

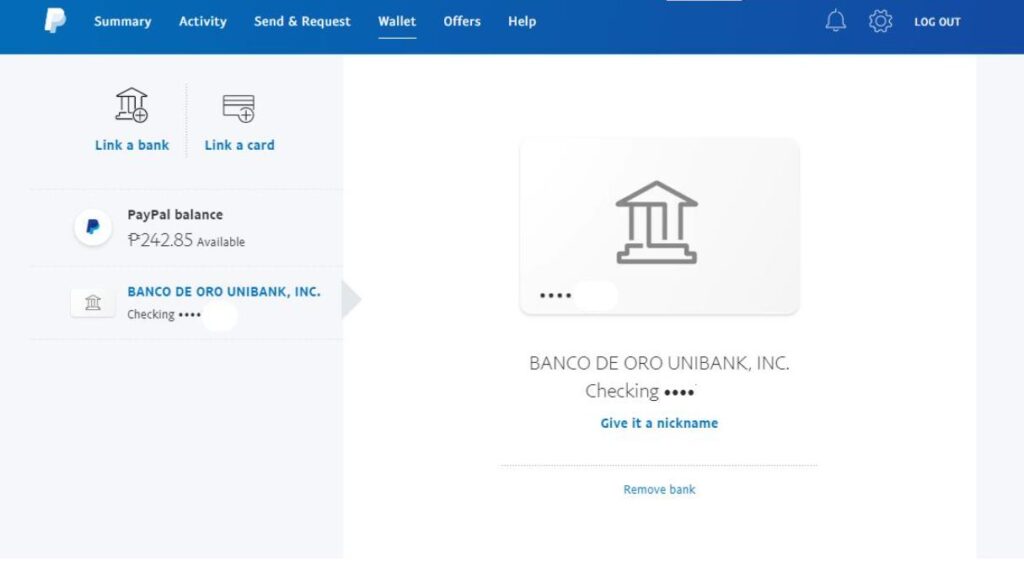

- Navigate to Linked Accounts: Go to the ‘Wallet’ or ‘Linked accounts’ section within your PayPal dashboard.

- Add a New Account: Click on ‘Link a bank account’ or ‘Add a new account.’

- Select Plaid: A list of banks and financial institutions will appear. Plaid should be one of the options. Select it.

- Enter Bank Details: Plaid’s interface will then prompt you to enter your online banking credentials for the bank account you wish to link.

- Verification: Plaid will verify your bank account details in real-time and send this verified information back to PayPal.

- Completion: Once the verification is successful, your bank account will be linked to your PayPal account, and you can start making transactions immediately.

By following these steps, you can easily and securely link your PayPal account with Plaid, making your online transactions more secure and efficient.

What Bank Is PayPal With?

PayPal is not tied to a single bank; rather, it acts as a financial intermediary that allows you to link multiple bank accounts or credit/debit cards to your PayPal account. PayPal has partnerships with various financial institutions to facilitate its services, but it operates independently as its own entity.

This means you can link accounts from different banks to your PayPal account and choose which one to use for specific transactions.

How Do You Manually Enter A Bank On Plaid?

Plaid generally provides a user interface where you can select your bank from a list and then enter your online banking credentials for verification. However, some platforms that use Plaid also offer the option to manually enter your bank account details.

In this case, you would select an option like “Add a bank manually” or “Enter bank details.” You’ll then be prompted to enter your routing number and account number.

After entering these details, Plaid may make two small deposits to your bank account to verify it. You’ll need to confirm these amounts to complete the verification process.

Why Is PayPal Not Linking My Bank Account?

There could be several reasons why PayPal is not linking your bank account:

- Incorrect Details: Ensure that you’ve entered the correct account number and routing number.

- Bank Restrictions: Some banks have restrictions on linking to third-party services like PayPal.

- PayPal Limitations: PayPal itself may have limitations or restrictions on linking certain types of accounts.

- Verification Issues: If you’re using Plaid for verification, ensure that you’ve entered the correct online banking credentials.

- Technical Glitches: Sometimes, technical issues can prevent successful linking. Try again later or contact customer support for assistance.

If you encounter issues, it’s best to contact PayPal’s customer support for a resolution.

Conclusion

In summary, while it’s not explicitly stated What Bank Is PayPal On Plaid, the partnership between the two companies serves to enhance user experience and security. Both companies are likely to continue evolving their services, making financial transactions even more seamless for users.

People Also Ask

Does PayPal Use Plaid?

Yes, PayPal is one of the financial institutions that connects to Plaid. Plaid serves as an intermediary to securely share your details and help process payments with PayPal.

Is It Safe to Use Plaid with PayPal?

Yes, using Plaid with PayPal is considered safe. Plaid provides additional layers of security, including encryption and multi-factor authentication, to ensure that transactions are secure.

What Are the Benefits of Connecting PayPal and Plaid?

Connecting PayPal and Plaid offers you a more secure way to make transactions. It also simplifies the process of linking your bank account to PayPal, making it quicker and more efficient.

Can I Use Plaid for International Transfers on PayPal?

While Plaid primarily focuses on domestic transactions, PayPal itself has features for international transfers. However, it’s advisable to compare fees for international transactions as there might be cheaper alternatives.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.