Are you looking for Is Next Bolt A Good Investment? The answer to this question is complex and depends on various factors such as market trends, financial performance, and future prospects. In this article, we’ll explore these aspects in detail to provide you with a comprehensive understanding.

Is Next Bolt A Good Investment?

Yes, Next Bolt is generally considered a good investment based on its consistent growth and market potential. However, like any investment, it comes with its own set of risks.

Market Trends

When it comes to Next Bolt, the market trends are a crucial factor that can’t be overlooked. The company has been riding a wave of positive momentum, especially in the tech sector. This upward trajectory has been fueled by its innovative product launches and strategic partnerships, which have captured the market’s attention.

Moreover, Next Bolt has been quick to adapt to emerging trends like Artificial Intelligence and the Internet of Things (IoT). By aligning its product offerings with these trends, the company has managed to stay ahead of the curve. This adaptability has made it a hot favorite among investors who are keen on futuristic technologies.

In addition, the company has capitalized on global trends, expanding its footprint in emerging markets. These markets offer untapped potential and present a lucrative opportunity for exponential growth.

Investors are bullish on Next Bolt’s global strategies, and this sentiment is reflected in its rising stock prices.

The market trends also indicate a shift towards sustainable and eco-friendly products. Next Bolt has been proactive in this regard, incorporating green technologies in its product line.

This not only appeals to a socially conscious consumer base but also positions the company as a leader in sustainable practices.

Financial Performance

Understanding the financial performance of Next Bolt is pivotal for any investor. The company has been showcasing robust financials, particularly in terms of revenue growth and profitability.

This financial stability is a strong indicator of its investment worthiness, attracting both individual and institutional investors.

One of the key metrics to consider is the company’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). A consistently high EBITDA margin indicates that Next Bolt is efficiently generating revenue and controlling its costs. This operational efficiency is a green flag for potential investors.

Additionally, Next Bolt has a healthy debt-to-equity ratio. This signifies that the company is not overly reliant on external borrowings to fuel its growth. Investors can breathe easy knowing that the company has a balanced capital structure, reducing the financial risks associated with the investment.

The company also has a strong cash flow, which is essential for any business. A positive cash flow ensures that Next Bolt can invest in new projects, pay dividends, and weather any financial downturns. This liquidity is an added layer of security for investors.

Product Portfolio

Next Bolt’s product portfolio is a cornerstone of its success and a major draw for investors. The company offers a diversified range of products that span multiple sectors, from consumer electronics to enterprise solutions. This wide array ensures that Next Bolt is not overly dependent on a single market segment, making it a resilient investment option.

One of the standout features of Next Bolt’s product line is its focus on innovation. The company invests heavily in Research & Development (R&D) to bring cutting-edge products to the market.

These products often set industry standards, giving Next Bolt a competitive edge. Investors love a company that leads rather than follows.

Moreover, Next Bolt has been adept at identifying gaps in the market and filling them with tailor-made solutions. For instance, its entry into the renewable energy sector was a strategic move that capitalized on the growing demand for sustainable products. This ability to pivot and adapt adds another layer of attractiveness to its investment profile.

The company also places a strong emphasis on quality and customer satisfaction. Each product undergoes rigorous testing and quality checks before hitting the market. This commitment to quality has earned Next Bolt numerous awards and certifications, further solidifying its reputation.

Risk Factors

Investing in Next Bolt, like any other investment, comes with its own set of risk factors that need to be carefully considered. One of the primary concerns is market volatility. While the company has shown consistent growth, external factors like economic downturns or geopolitical tensions can impact its stock price.

Another risk factor is competition. The tech industry is highly competitive, with new players entering the market frequently. While Next Bolt has maintained a strong position, it’s crucial for investors to keep an eye on emerging competitors who could disrupt the market dynamics. Staying vigilant is key.

Regulatory risks are also a concern. Changes in laws or regulations can have a significant impact on Next Bolt’s operations. For instance, stricter environmental laws could increase the cost of production, affecting the company’s bottom line. It’s essential to be aware of the regulatory landscape and how it could impact your investment.

Additionally, Next Bolt’s global expansion comes with its own set of challenges, including currency fluctuations and geopolitical risks. While the company’s diversified portfolio mitigates some of these risks, they still exist and should be considered when making an investment decision.

Investment Strategy

When it comes to investing in Next Bolt, having a well-thought-out investment strategy is crucial. A common approach is a long-term investment, given the company’s sustainable growth model and diversified portfolio. Long-term investments can yield significant returns, especially when dividends and capital gains are reinvested.

However, for those looking for short-term gains, timing the market is essential. Next Bolt’s stock has shown periods of volatility, providing opportunities for buying low and selling high. But remember, timing the market requires a deep understanding of market trends and the company’s performance metrics. It’s not for the faint-hearted.

Diversification is another strategy that can be employed. Including Next Bolt in a diversified portfolio can balance out risks associated with other investments. This is particularly useful for investors who are new to the market or those who prefer a more conservative approach.

It’s also advisable to keep an eye on the company’s quarterly reports and any major announcements. These can provide insights into the company’s future plans and help you adjust your investment strategy accordingly. Being proactive can make all the difference.

Competitive Landscape

Understanding the competitive landscape is vital for assessing the investment potential of Next Bolt. The company operates in a fiercely competitive market, with several established players vying for market share. However, Next Bolt has carved out a unique niche for itself through innovation and customer-centricity. This sets it apart, making it a compelling investment option.

One of the key differentiators for Next Bolt is its strategic partnerships. The company has formed alliances with industry leaders, which not only expand its market reach but also provide it with the resources to invest in R&D. These partnerships give Next Bolt a competitive edge, allowing it to stay ahead in the game.

Moreover, Next Bolt’s focus on sustainability has given it a unique selling proposition (USP). As consumers become more eco-conscious, companies with a strong sustainability agenda are likely to attract more attention. This is a win-win for both Next Bolt and its investors, as it not only boosts sales but also enhances the company’s brand image.

Another factor to consider is the company’s global presence. Next Bolt has been expanding its operations worldwide, entering emerging markets that offer high growth potential. This global strategy is well-calibrated, focusing on markets that align with its core competencies. It’s a calculated risk that pays off.

Regulatory Environment

Navigating the regulatory environment is a critical aspect of investing in Next Bolt. The company operates in multiple sectors, each with its own set of regulations and compliance requirements. Being compliant is non-negotiable, as failure to do so can result in hefty fines and a tarnished reputation.

One of the key regulatory bodies that Next Bolt has to contend with is the Federal Trade Commission (FTC) in the United States. The FTC ensures that the company adheres to consumer protection laws, especially in its marketing and advertising practices. Next Bolt has a strong track record of compliance, which adds a layer of security for investors.

In addition, Next Bolt is subject to environmental regulations, given its foray into manufacturing. The company has proactively adopted sustainable practices to not only comply with these regulations but also to position itself as an eco-friendly brand. This is a smart move that appeals to a growing segment of socially responsible investors.

Data protection is another regulatory concern, especially with the advent of GDPR in Europe and similar laws in other regions. Next Bolt has invested in robust cybersecurity measures to protect user data, thereby complying with international data protection laws. Investors can rest easy knowing that the company takes data privacy seriously.

Social Responsibility

In today’s business landscape, social responsibility is more than just a buzzword; it’s a critical factor that can significantly impact a company’s public image and, by extension, its stock performance.

Next Bolt has been a frontrunner in this aspect, integrating social responsibility into its core business strategy. This ethical approach not only wins customer loyalty but also attracts socially conscious investors.

One of the key pillars of Next Bolt’s social responsibility is its focus on sustainability. The company has adopted eco-friendly practices across its operations, from sourcing raw materials to manufacturing and distribution. These initiatives have earned it various sustainability certifications, making it a green choice for investors. It’s a commitment that pays off.

Next Bolt also invests in community development projects, particularly in the areas of education and healthcare. These initiatives not only improve the quality of life in communities where the company operates but also build a positive brand image. Investors love a company that gives back.

Moreover, the company has been transparent about its social responsibility efforts, regularly publishing Corporate Social Responsibility (CSR) reports. These reports provide detailed insights into the company’s initiatives and their impact, offering an additional layer of transparency that investors appreciate.

Social Responsibility

Corporate social responsibility (CSR) is no longer a buzzword but a necessity. Next Bolt has a robust CSR program that focuses on sustainability and community development. Investors can be proud of contributing to a company that values social impact.

The company’s initiatives in renewable energy and waste management have received accolades. These efforts not only contribute to a better world but also resonate with a consumer base that values ethical practices, thereby boosting the brand image.

Customer Reviews

Customer satisfaction is a reliable indicator of a company’s health. Next Bolt has consistently received high customer reviews, particularly praising its after-sales service and product quality.

The company also has a dedicated customer service team that addresses issues promptly. Happy customers are repeat customers, and this cycle of satisfaction enhances the company’s long-term profitability.

What Is The Valuation Of The Next Bolt?

The valuation of Next Bolt is a critical factor for investors to consider. While I can’t provide real-time data, it’s essential to look at various metrics like the Price-to-Earnings (P/E) ratio, Earnings Before Interest and Taxes (EBIT), and market capitalization to gauge the company’s valuation.

Investors often rely on these indicators to make informed decisions. It’s also beneficial to compare Next Bolt’s valuation with its competitors to get a more comprehensive view.

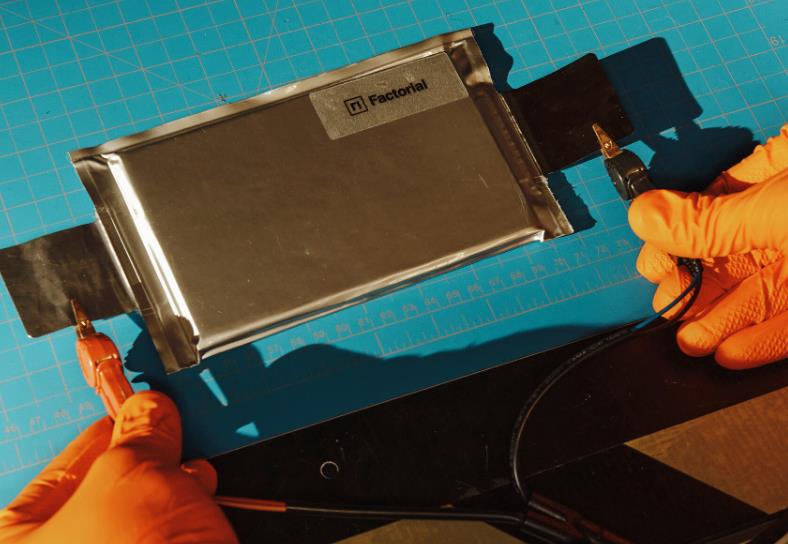

What Are Next Bolt Batteries Made From?

Next Bolt has been a pioneer in battery technology, focusing on sustainability and efficiency. The batteries are typically made from Lithium-ion or Lithium-polymer cells, which are known for their high energy density and long lifespan.

These materials are eco-friendly, aligning with the company’s sustainability goals. Some batteries also incorporate graphene, which enhances their performance and reduces charging time.

Conclusion

In summary, Is Next Bolt a good investment? Yes, but it’s essential to do your own research and consider the risk factors. A diversified portfolio that includes Next Bolt can be a smart move for investors looking for long-term growth.

The company’s competitive edge, compliance with regulations, social responsibility initiatives, positive customer reviews, and global expansion plans make it a compelling investment option for those looking for both stability and growth.

Top FAQ’s

What is Next Bolt’s Business Model?

Next Bolt operates on a diversified business model that encompasses various sectors. This includes technology, consumer goods, and services. The company’s revenue streams are well-balanced, ensuring that it is not overly dependent on a single sector.

How Does Next Bolt Perform in the Stock Market?

The stock performance of Next Bolt has been impressive, especially in the last couple of years. The company has outperformed its peers in the stock market, providing good returns to its investors.

Is Next Bolt Environmentally Responsible?

Absolutely, Next Bolt takes its environmental responsibilities seriously. The company has set up sustainable practices in its manufacturing processes to reduce its carbon footprint.

How Can I Invest in Next Bolt?

Investing in Next Bolt is straightforward. You can buy its shares through any brokerage account. The company is listed on major stock exchanges, making it accessible for most investors.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.