Let’s explore How To Wire Transfer Money With Chime? Chime does not accept wire transfers. Since Chime wasn’t designed for sizable international transactions or huge dollar transfers, it is doubtful that their stance will change.

Like Chime, most fintech businesses run similarly. Their accounts are typically targeted at the unbanked or underbanked, who are significantly less likely than anyone else to receive a wire transfer.

Wire transfers are usually used when transferring exceptionally large sums of money, such as when buying a property or sending money over international borders.

When I worked in banking, I seldom sent out transfers for less than $10,000. Chime accepts ACH transfers. Any incoming or outgoing ACH transfer has limits of $10,000 per day and $25,000 per month.

How To Wire Transfer Money With Chime?

Chime does not allow wire transfers because it was not designed for substantial international or large-dollar transfers. ACH transfers are accepted by Chime, with daily and monthly limits of $10,000 and $25,000, respectively.

Does Chime Accept Money Transfers?

Chime does allow various sorts of transfers, but not wire transfers. Most of the time, all you need to complete a transfer is a routing number, an account number, the name of the person or business you’re transferring it to, and their bank’s name.

Chime gives this information to its customers when they open an account. Your routing and account numbers are readily available, and Chime provides them in two locations.

Your routing and account numbers can first be found in the settings. Scroll to the Account data area by selecting the settings button in the Chime app’s upper left corner. The Account data section contains the following:

- Your routing number.

- Account number.

- A button to set up direct deposit.

- A button to take you to your limitations.

Speaking of limits, if you intend to receive transfers through the Chime app, keep your Chime limits in mind. Knowing in advance will help prevent a significant transfer from being denied and returned.

Chime has a $10,000 daily cap and a $25,000 monthly cap on incoming and outgoing ACH transactions, as I mentioned at the beginning of the article.

The daily and monthly limits for using the Pay Anyone tool too. Paying anyone is $2,000 and $10,000, respectively.

Does Chime Accept ACH Transfers?

Chime does not accept wire transactions. However, ACH transfers are. While ACH transfers and wire transfers have very similar information requirements before they can be transmitted, they differ in monetary quantities.

ACH transfers are frequently used for domestic and international transfers of modest currency amounts. The recipient’s account number, routing number, account name, and bank name are all you need to send money to someone else through an ACH transfer.

Those specifications ought to be familiar if they are. You also require to send a wire transfer. ACH transfers often have significantly lower cash amounts, typically in the thousands.

My customers often sent at least six figures while I worked at Chase Bank since title companies were the most frequent recipients of my wire transfers.

If you get an ACH transfer, the amount sent to you likely ranges between $2,000 and $10,000. More than that could be transmitted by wire.

Chime’s daily ACH transfer cap is $10,000, and its monthly cap is $25,000 per transaction. Initiated from Chime, that is to send or receive ACH transfers.

I recommend opening a regular bank account instead of an Internet bank if you need to receive a wire transfer. Traditional bank accounts are better suited for wire transfers because banks are built up under the wiring system.

Be aware that traditional banks may charge a fee for sending or receiving wires.

Can Someone Send Money From Their Bank Account To My Chime Account?

However, others may need help to transfer money from their bank accounts to their Chime accounts. Could your friend send $20 directly to your Chime account from their bank account if they wanted to pay you? Sadly, the response is no, they cannot. You alone are the only one who can move funds from a bank account into your Chime account.

You must use Plaid to connect your bank account and Chime before you may transfer money between them. Fintech businesses all around America employ Plaid, a well-liked fintech connectivity service.

Although Plaid is highly useful, only one bank account can be linked to Chime.

Try to persuade someone to download Chime if they want to send you money from their bank account. The only drawback is the space it takes up on your phone. The app, opening an account, and sending money are all free.

Transfer Money Between Banks: 6 Ways To Do It

Bank-To-Bank Transfer

A bank-to-bank transfer is the most practical transfer method if you own both bank accounts. Transfers from one bank to another across connected accounts are frequently quick and free.

The receiving bank will receive the transfer after about 2 or 3 business days (the exact time will depend on the bank and whether you are sending money locally or abroad). Transfer arrangements can be made with the sending bank.

To move money from one bank to another, adhere to these steps:

- Open the website or mobile app for your bank.

- Click the transfer option and select “transfer to another bank.”

- Provide account details, such as the account number and routing number, for the account at the other bank.

- Verify the new account by entering your username, password, and other verification information.

- Complete the transfer by choosing the sending and receiving accounts, entering the transfer amount, and choosing the day the transaction should occur.

Note: This process may vary depending on your bank. Verify with your bank to see if bank-to-bank transfers are free; this may only be true for some banks.

Peer-To-Peer Transfer

Third-party transfers are your best option to transfer money to someone else’s bank account. Peer-to-peer or P2P payments provide quick and secure ways to send money to loved ones, associates, or a company.

Although most of these services are free, some may levy a small fee for specific circumstances, like sending money with a credit card or transferring money the same day etc.

BeforeBefore transferring money, ensure you know the P2P app’s costs, timing requirements, and restrictions. For instance, some payment apps may set transaction limits or prohibit overseas transactions.

In these circumstances, you might have to select a different payment option or be ready to fork over a higher price.

Wire Transfer

A wire transfer will be useful when you need to transfer a significant sum of money quickly. Through wire transfers, money can be transferred swiftly and safely, but there is typically a cost associated with this technique.

Fee fees will change depending on the bank and whether you’re sending money locally or abroad. On average, domestic wire transfer fees range from $25 to $30, while international wire transfer prices range from $45 to $50.

You can wire transfers directly through your bank or a non-bank service provider, like Wise or Western Union. The recipient’s name, account number, and routing number are required.

Wire transfers are usually accessible within a day or two of business. Take special care to send the correct amount of money to the correct recipient because wire transfers are extremely difficult or even impossible to reverse.

Paper Checks

Although writing a paper check may appear like an old-fashioned, ineffective way to send money, paper checks are useful in today’s technologically advanced society.

A paper check is a simple method of moving money between institutions. You can write a check to yourself in the amount you transfer, deposit it in your new account, and then continue.

Remember that the cheque may need to clear your account within a few business days to be deposited. You can transfer money without ever leaving your house, thanks to the mobile check deposits that some banks and financial institutions offer through their mobile banking apps.

Email Money Transfer

Email money transfers (EMTs) are another choice for transferring and receiving funds from one bank to another. Some banks and financial organizations provide an email money transfer service that enables customers to transfer money between personal accounts using email addresses or mobile phone numbers.

A transfer network, such as Zelle or Google Pay, transports the funds when you use an EMT. Participating banks will email the recipient to advise them of the transfer.

Receiving money through an EMT is often free; however, using the service typically costs a small amount of money from the sender.

The recipient won’t need to provide you with their bank account information, but before they can get the money, they will need to respond to several security questions. Using this technique, the money will often take a few days to appear in the recipient’s account.

Online Bill Pay

Customers of some banks and financial organizations can pay their bills online. This approach comprises a bank or credit union issuing a check or electronic payment to a business or bank account on your behalf. You must enter your account and choose the bill pay option to set up online bill payment.

To send money to oneself, you would enter your new account information after entering the account information for the recipient account.

Additionally, it would help if you decided whether you want the payment to be regular or one-time, the amount you wish to send, and the timing of the payment.

Safety Tips For Sending Money Online

To avoid falling victim to money fraud, use the following safety precautions while sending your hard-earned money:

- When sending money online, ensure the network connection is encrypted by checking for the letters https in the browser address bar & the lock icon in the top left corner.

- Never divulge your login information to anyone, not even the app’s tech support staff.

- Protect your accounts using built-in security tools like PINs or multi-factor authentication.

- Use peer-to-peer payment apps exclusively with people you know, if possible.

- Record each time you send money.

- Before sending the payment, confirm the dollar amount and the recipient’s information.

- Always double-check unexpected requests from people you know, as con artists may use the accounts of your loved ones or friends to conduct fraud.

Conclusion

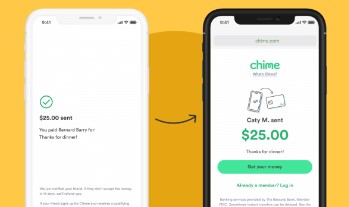

The Chime app does not now support sending wire transfers, and it shouldn’t. Thanks to the Pay Anyone function, you can pay anyone via the Chime app.

You can pay anyone from Chime if they have a valid debit card, which is how the Pay Anyone feature operates.

They can accept it even without a Chime account or the Chime app. When you pay someone using the Pay Anyone function, Chime will send them a link so they may receive the payment.

They click on it using their phone and input their debit card details to access it. To do this, they have 14 days. The link to the Pay Anyone feature is free to email or text. That’s all I hope you understand How To Wire Transfer Money With Chime?

Frequently Asked Questions

Can Chime do wire transfers?

Chime does not presently support wire transfers. Any money wired to your Chime account will instantly be returned to the sender. Chime advises using a third-party service like TransferWise for sending or receiving money internationally!

Does Chime allow international transactions?

Your Chime card can be used for purchases and cash withdrawals everywhere Visa is accepted. However, you must enable international transactions in the app’s settings. Foreign transactions with Chime are free. However, foreign ATM withdrawals have a $2.50 cost.

How long does it take Chime to accept a wire transfer?

For instance, a bank-to-bank transfer often takes two to three business days, whereas a wire transfer usually completes within a few hours.

How much is a wire transfer from Chime?

$15 per transaction is the cost of receiving domestic wire transfers. Fees for receiving international wire transfers are $16 per transaction. The cost of a domestic wire transfer outbound is $30. Outgoing international wire transfers cost $45 when sent in US dollars.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.