Are you looking for How To Invest In SparkCharge? This is a question that many are asking as the world shifts towards electric vehicles (EVs). Investing in SparkCharge can be a strategic move for businesses looking to embrace this electric revolution. Here’s a comprehensive guide to help you make an informed decision.

How To Invest In SparkCharge?

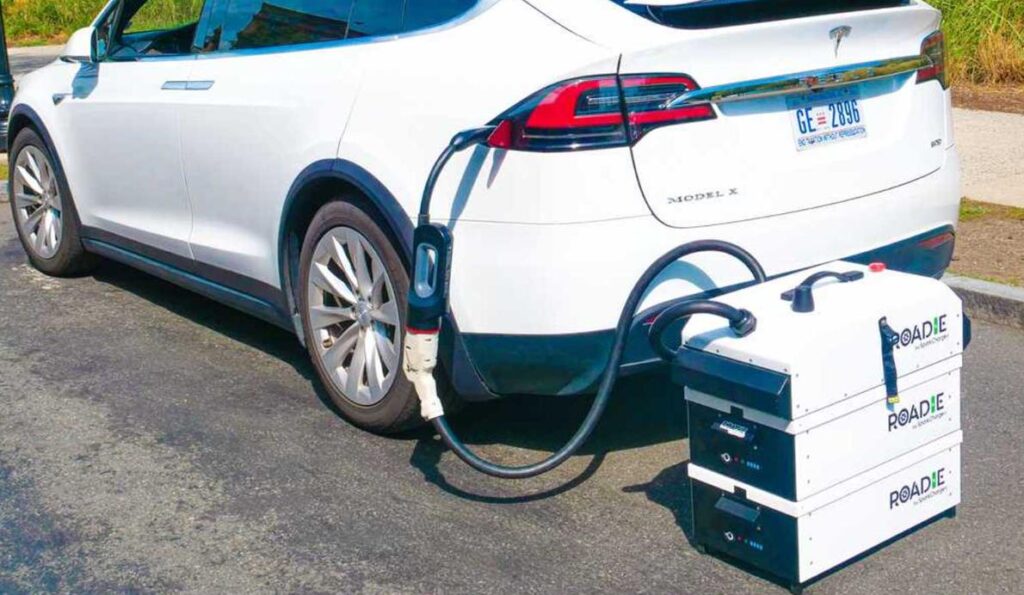

Investing in SparkCharge involves understanding your business needs for EV charging. Consider factors like location, number of vehicles, and charging speeds. SparkCharge offers solutions like the Roadie Portable, a portable DC fast charger, and SparkCharge Fleet, a fast EV charging network.

Assessing Your Business Needs

Before diving in, evaluate your business’s specific requirements. The number of electric vehicles you have will determine the number of EV chargers needed. Typically, you’ll need at least 3 chargers for every 10 vehicles.

Understanding Charging Station Types

Charging stations come in various types: Level 1, Level 2, and Level 3. Level 1 is the slowest, while Level 3 or DC fast charging is the fastest. Your choice will depend on your business needs and the speed of charging required.

Evaluating Infrastructure Costs

Costs aren’t just about the charging station. You’ll also need to consider installation expenses, electrical upgrades, and ongoing maintenance. Level 3 charging stations can cost up to $120,000+ for installation.

Exploring Charging Network Options

SparkCharge offers three different charging-as-a-service programs: SparkCharge Fleet, SparkCharge Out of Charge (OOC), and SparkCharge Mobile App. Each program serves different business needs and offers various benefits.

Planning for Scalability

Your future growth plans and projected demand for EV charging should be considered. Investing in scalable charging infrastructure ensures you can accommodate increasing EV adoption.

Providing a Seamless User Experience

User experience is crucial. Factors like user-friendly interfaces, reliable connectivity, and customer support contribute to a positive charging experience.

Leveraging Incentives and Grants

Many governments offer financial support to businesses investing in EV charging infrastructure. SparkCharge can help you navigate these incentives and programs.

Understanding the Technology Behind Charging

The technology that powers EV charging stations is evolving rapidly. Understanding the nuances can give you a competitive edge. For instance, SparkCharge’s Roadie Portable offers portable DC fast charging, a game-changer in the industry.

Battery Management Systems

Battery Management Systems (BMS) are crucial for optimizing the charging and discharging process. A good BMS can extend the lifespan of the batteries used in EVs.

Optimizing Your Investment

Your investment in SparkCharge should be more than just a capital expenditure. Consider it as an asset that can generate revenue and enhance your brand image.

Revenue Streams

You can monetize your charging stations by offering paid charging services. SparkCharge’s solutions come with billing options that make this process seamless.

Partnerships and Collaborations

Forming partnerships with other businesses or joining a charging network can amplify your reach. SparkCharge offers programs like SparkCharge Fleet and SparkCharge Mobile App that can be integrated into your business model.

Industry Alliances

Joining industry alliances can provide you with valuable insights and resources. These alliances often offer research data, best practices, and networking opportunities.

Payment Solutions

Offering multiple payment solutions can enhance the user experience. From mobile payments to card swipes, the easier you make it for the customer, the better.

Payment Security

Ensuring secure payment options is not just good practice but also builds trust among your users.

Marketing Your Charging Stations

Promoting your charging stations effectively can attract a wider customer base. Highlight the convenience, speed, and eco-friendliness of your SparkCharge stations.

Digital Marketing Strategies

Utilize social media, SEO, and email marketing to reach a broader audience. Make sure to highlight the unique selling points of your SparkCharge investment.

Legal Considerations

Understanding the legal landscape is crucial. This includes zoning laws, permits, and any state or federal regulations that might apply.

Compliance and Standards

Ensure that your SparkCharge stations meet all the necessary safety and quality standards. Non-compliance can result in hefty fines and legal issues.

Sustainability Goals

Last but not least, align your SparkCharge investment with your long-term sustainability goals. This not only enhances your brand image but also contributes to a greener future.

Carbon Footprint

Investing in SparkCharge can significantly reduce your business’s carbon footprint. It’s a win-win for both the environment and your brand.

Can You Buy SparkCharge Stock?

As of the latest information available, SparkCharge has not gone public, meaning retail investors cannot buy its stock. The company has successfully raised $35.8 million in total funding and may continue to raise more through venture capital. The opportunity for retail investors to invest would only arise if the company decides to go public.

Is SparkCharge Profitable?

SparkCharge has shown promising growth, especially after its appearance on Shark Tank. The company was valued at $30 million as of 2023. It has raised a significant amount of funding, including $30 million from Series A funding led by Pendulum and Tale Venture Partners.

The business is estimated to make an annual revenue of $5 million to $8 million. While the company is not yet publicly confirmed as profitable, its rapid growth and substantial funding indicate a strong financial position.

Which Stock Is Best For EV?

Tesla remains a dominant force in the EV market, with its stock showing consistent growth. Its innovation in battery technology and self-driving capabilities sets it apart. However, newcomers like Rivian and established giants like Ford are also making waves.

Ford’s Mustang Mach-E and Rivian’s R1T pickup have garnered significant attention. Diversifying your portfolio with a mix of these stocks could be a smart move.

NIO, a Chinese EV manufacturer, is another stock to watch. They’ve made significant strides in battery-swapping technology. Investing in NIO can offer global diversification to your portfolio. Always consult a financial advisor before making investment decisions.

Is Owning A Charging Station Profitable?

Owning a charging station can be a lucrative venture, especially as EV adoption rates soar. High-traffic locations like shopping malls and office complexes offer the best ROI. Government incentives and grants can also offset initial setup costs, making it even more appealing.

However, profitability isn’t guaranteed. Factors like electricity rates, maintenance, and competition can affect earnings.

Some owners opt for a subscription model to ensure a steady income. It’s crucial to conduct a thorough market analysis and business plan before diving in.

Conclusion

Investing in SparkCharge is not just about meeting the evolving needs of customers but also about positioning your business as a forward-thinking leader in sustainability. By understanding various aspects of charging infrastructure and planning for future growth, you can make informed decisions that maximize the benefits of EV charging.

Frequently Asked Questions

Is SparkCharge Going Public?

As of now, there’s no official update on SparkCharge going public. The company has raised $35.8 million in total and may raise more through venture capitalists. Retail investors can only invest when the company goes public.

What Makes SparkCharge Attractive to Investors?

SparkCharge has garnered attention for its innovative technology. It has created the world’s first mobile EV charging network, allowing EV drivers to charge their vehicles anytime, anywhere. This innovation makes it a compelling investment opportunity.

How Is SparkCharge Contributing to Sustainability?

According to reports, SparkCharge is expected to prevent more than 85 tonnes of carbon dioxide pollution in 2022. As EVs gain popularity due to climate change, companies like SparkCharge stand to benefit.

What Is SparkCharge’s Current Market Reach?

SparkCharge’s mobile application is available in four cities, and the company plans to expand its services to additional markets. It has already delivered over 112,000 miles of range to electric vehicle owners, indicating rapid growth.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.