Are you looking for How To Invest In Adden Energy? Investing in Adden Energy is more than just a financial decision; it’s a step towards supporting next-gen battery technologies aimed at combating climate change. This comprehensive guide will walk you through the ins and outs of making a smart investment in this promising startup. Let’s get started!

Key Takeaways

- Understand Adden Energy’s Business Model

- Assess Risk and Return

- Determine Investment Horizon

- Choose the Investment Vehicle

- Open a Brokerage Account

- Decide Investment Amount

- Monitor Performance

How To Invest In Adden Energy?

Investing in Adden Energy is not just about buying stocks. It’s about understanding the company’s business model, market presence, and financial stability.

Research and Analysis

Before you invest, understand Adden Energy’s business model. Look into their products, services, and market presence. Analyze industry trends and competition.

Assess Risk and Return

Evaluate the risk-return profile. Consider the company’s financial stability, historical returns, and growth projections. Diversify your portfolio to mitigate risks.

Determine Investment Horizon

Define your investment horizon based on your financial goals. Adden Energy is suitable for medium to long-term investment horizons.

Choose the Investment Vehicle

Decide on the investment vehicle that aligns with your strategy. Options include stocks, renewable energy mutual funds, or ETFs.

Open a Brokerage Account

If you opt for direct stock investment, open a brokerage account. Ensure the brokerage offers low fees and a user-friendly platform.

Decide Investment Amount

Decide the amount you’re willing to invest. Always invest what you can afford to lose.

Monitor Performance

Stay updated on Adden Energy’s performance. Regularly review your investment strategy and adjust it if necessary.

Understand Adden Energy’s Valuation

Valuation is a key factor in investment decisions. Research Adden Energy’s post-money valuation and revenue to gauge its worth.

Explore Funding Rounds

Adden Energy has raised a total of $5.15M over 2 rounds from 4 investors. This information can be crucial for assessing the company’s financial health.

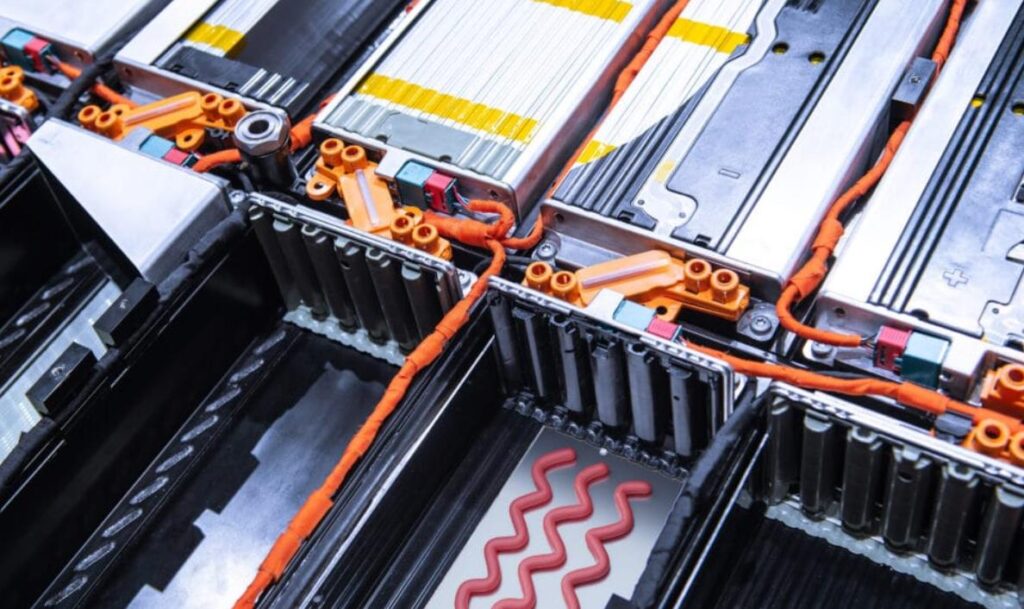

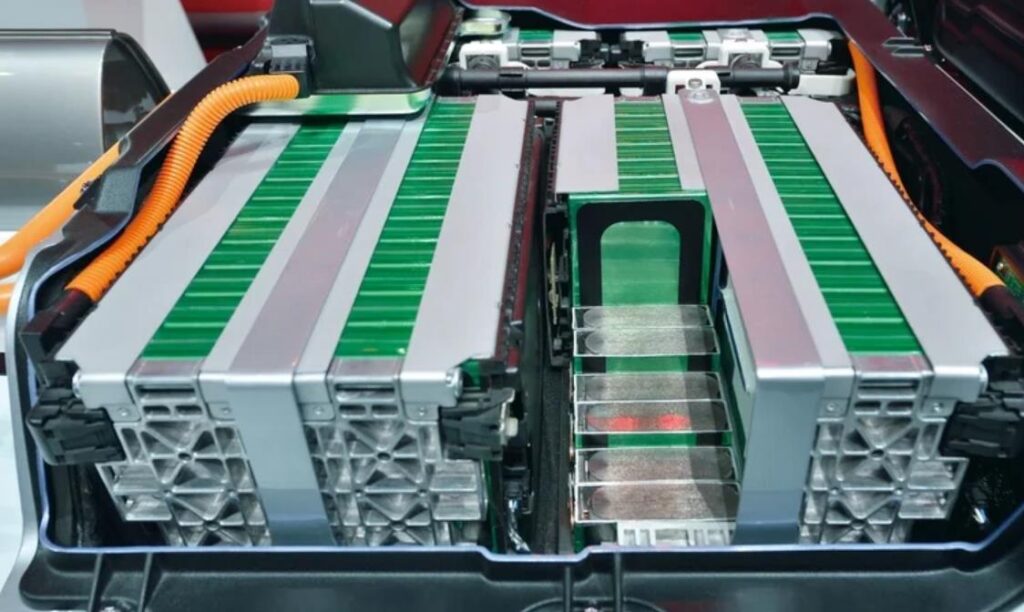

Know the Technology Behind Adden Energy

The company is combating climate change with next-gen battery technologies. Understanding this tech can give you an edge.

Learn About Ownership Structure

Before investing, it’s essential to understand the company’s ownership structure. This can include whether the shares are publicly traded or privately held.

Consider the Company’s Innovations

Adden Energy has developed an EV battery that charges in 3 minutes and lasts 20 years. Innovations like these can be a game-changer for your investment.

Contacting Adden Energy

If you have specific questions or need more information, consider reaching out to Adden Energy directly through their contact form.

Stay Updated on News and Developments

Keep an eye on news and developments related to Adden Energy. Harvard’s Office of Technology Development has granted an exclusive technology license to the company.

Can You Buy Stock In Adden Energy?

As of now, there is no public information indicating that Adden Energy is publicly traded. The company has recently closed a seed funding round, suggesting it’s still in the early stages of its financial journey.

If you’re interested in investing, it’s crucial to keep an eye on the company’s announcements for any future IPO or investment opportunities.

Who Owns Adden Energy?

Adden Energy was founded by a group of Harvard scientists and alumni. The key players include William Fitzhugh, PhD (Co-Founder & CEO), Luhan Ye, PhD (Co-Founder & CTO), Xin Li, PhD (Co-Founder & Board Member), and Fred Hu, PhD (Co-Founder & Board Member).

The company received its first round of venture funding in early 2022 from Primavera Capital Group, Rhapsody Partners, and MassVentures.

Is Adden Energy Battery Real?

Yes, Adden Energy’s battery technology is real and groundbreaking. Originating from discoveries at Harvard’s John A. Paulson School of Engineering and Applied Sciences, the company has developed a unique battery technology.

By controlling the mechano-electrochemical environment of solid-state batteries, they’ve drastically improved stability. Their technology roadmap is focused on scaling this performance into commercially acceptable Amp-hour sized cells.

Is Adden Energy The Next Big Energy Stock?

While it’s too early to definitively say, Adden Energy shows promising signs of becoming a significant player in the energy sector. With $5.15 million raised in seed funding and a technology license from Harvard to scale solid-state battery technology for electric vehicles, the company is well-positioned for growth.

However, as it is not publicly traded yet, potential investors should keep an eye on the company’s future announcements.

Conclusion

Investing in Adden Energy can be a lucrative venture if done wisely. Always consult professionals and keep an eye on the company’s performance to align your investment with your financial goals.

People Also Ask

When was the last funding round for Adden Energy?

The last funding round for Adden Energy was closed on February 25, 2022. This was a Seed round, indicating that the company is in an early stage but has garnered investor attention.

How is Adden Energy revolutionizing EV batteries?

With over $5 million in seed funding, Adden Energy is set to revolutionize EV batteries. They have developed a battery that charges in just 3 minutes and lasts for 20 years.

What is Adden Energy’s valuation?

The valuation of Adden Energy is not publicly disclosed. However, you can use platforms like PitchBook to explore their full profile, including valuation, funding, and cap tables.

How can I contact Adden Energy for investment queries?

You can contact Adden Energy through their official website. They have a contact form where you can send your questions or comments about investing.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.