I’ve had firsthand experience with the challenges of tax planning in a professional setting. Discovering the cost-effective and efficient Corvee Tax Planning Software was a game-changer. This article delves into the details of How Much Is Corvee Tax Planning Software? Its pricing, features, and how it simplifies tax planning for professionals. Next, we will explore the multi-entity tax planning capabilities of Corvee, a feature that significantly enhances tax strategy formulation for diverse client portfolios.

Key Takeaways

- Versatility: Designed for accounting firms, CPAs, and tax professionals.

- Comprehensive Tools: Offers federal, state, and local tax planning.

- Cloud-Based Software: Ensures accessibility and efficiency.

- Target Audience: Beneficial for both individuals and businesses.

How Much Is Corvee Tax Planning Software?

Corvee Tax Planning Software costs around $595 per year. This price is for the annual subscription, making it an affordable choice for accounting firms, CPAs, and tax professionals who need reliable tax planning tools.

The software offers comprehensive solutions for federal, state, and local tax planning, and it’s designed to be user-friendly for different levels of expertise.

Pricing Overview

When it comes to pricing, Corvee Tax Planning Software offers several options, ensuring flexibility and accessibility for different users:

- Monthly Subscription: A starting price of $33.00 per month, catering to users who prefer a monthly commitment.

- Annual Subscription: An option for an annual subscription at $595.00, appealing to those looking for a long-term solution.

- Customizable Plans: Additionally, a price point of $330.00 is mentioned, though the specifics of this plan are not detailed.

Comprehensive Tax Planning Solutions

Corvee’s software is specifically tailored to streamline tax planning processes. Its features encompass a broad spectrum of tax-related needs:

- Automated Tax Planning: Simplifies and accelerates the tax planning process.

- Multi-Entity Support: Addresses the complexities of various business structures.

- Client Collaboration: Facilitates effective communication and strategy formulation with clients.

Comparative Analysis

Corvee Tax Planning Software is often compared with other market alternatives. Such comparisons enable users to make an informed decision based on their specific needs:

- Comparison with TaxDome: While Corvee focuses on tax planning, TaxDome offers a broader range of services including client management and document storage.

- Market Positioning: Positioned as a competitive choice for accounting firms looking for a specialized tax planning tool.

User Accessibility and Interface

The cloud-based nature of Corvee Tax Planning Software ensures that it is accessible from various devices, offering a user-friendly interface that caters to professionals at different levels of tax planning expertise. This aspect of the software contributes significantly to its usability and popularity.

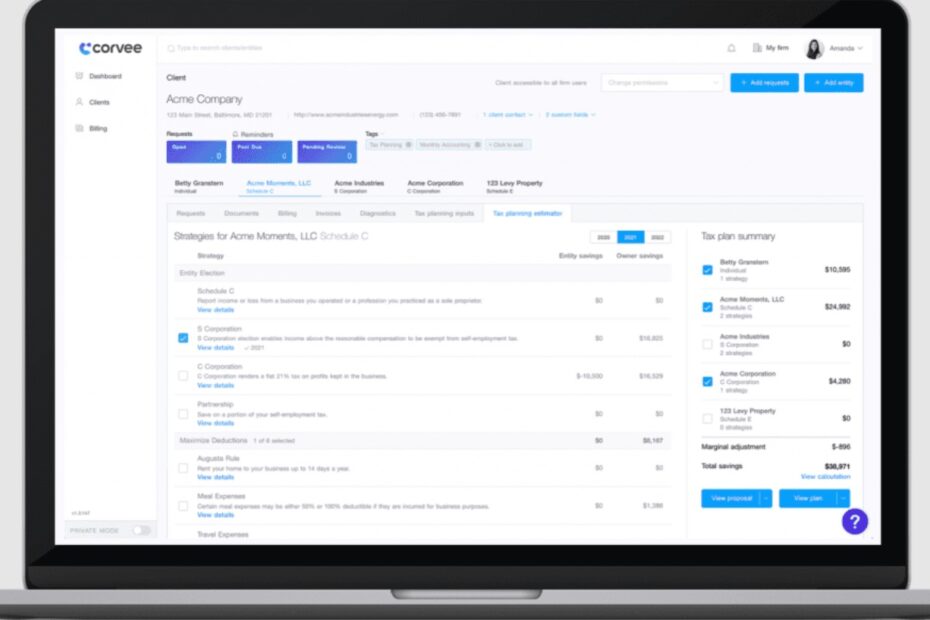

Multi-Entity Tax Planning

Corvee Tax Planning Software excels in multi-entity tax planning. This feature allows users to view and analyze a client’s tax scenario across all entities in a single, consolidated tax calculation.

This capability is particularly useful for accounting firms dealing with clients who operate multiple businesses or have complex financial structures. It enables professionals to assess the impact of entity changes on taxes, thereby aiding in making decisions that optimize tax efficiency for their clients.

Entity Optimization A critical component of Corvee’s offerings is its entity optimization tools. These tools assist users in modeling the impact of changes in entity type and compensation on tax efficiency.

With this feature, professionals can compare various entity types and understand how each change influences taxes across different forms and jurisdictions. This level of detail is crucial for firms that aim to provide tailored tax advice and strategies to their clients.

Tax Calculation and Estimation

One of the standout features of Corvee Tax Planning Software is its tax calculation capability. The software allows users to estimate taxes owed at both federal and state levels over multiple years.

Supporting a wide range of federal, state, and local forms, the calculations are based on numerous form inputs, ensuring maximum accuracy. This feature is invaluable for long-term tax planning and forecasting, offering a clear view of potential tax liabilities and savings.

Smart Data Collection with Questionnaires Corvee simplifies the data collection process through its smart questionnaires. These adaptive questionnaires are designed to delve deeper into client financial details when needed while omitting unnecessary queries.

This smart approach to data gathering not only saves time but also ensures that all relevant financial information is accurately captured for effective tax planning.

Comprehensive Tax Strategies

A key strength of Corvee Tax Planning Software is its extensive database of over 1,500 tax strategies. This continually updated repository provides users with a broad spectrum of strategies to minimize tax liabilities.

Covering areas such as maximizing deductions, legal entity structures, retirement planning, and asset protection, the software offers strategies for various niches and advanced tax planning scenarios.

Conclusion

In conclusion, Corvee Tax Planning Software emerges as a versatile and comprehensive tool for tax planning. Its pricing structure accommodates various user preferences and budgets, while its features are tailored to meet the complex needs of tax planning for both individuals and businesses. Its comparison with other market alternatives highlights its strong positioning as a dedicated tax planning solution.

Frequently Asked Questions

Who is Corvee Tax Planning Software designed for?

Corvee Tax Planning is tailored for accountants, tax preparers, and financial advisors. It enables these professionals to analyze a client’s financial situation and develop strategies to legally minimize their tax burden.

How does Corvee Tax Planning assist in entity optimization?

The software provides tools to model the tax efficiency impact of entity and compensation changes. Users can compare different entity types and see the tax implications across various forms and jurisdictions.

What makes Corvee’s tax calculation feature stand out?

Corvee’s tax calculation feature supports comprehensive tax estimation across multiple years and jurisdictions, ensuring accuracy with a wide range of form inputs.

How does Corvee ensure efficient data collection?

Corvee employs smart questionnaires that adapt to client inputs, focusing on relevant information and skipping unnecessary details for efficient and accurate data collection.

What variety of tax strategies does Corvee offer?

Corvee offers over 1,500 tax strategies, continually updated to cover various areas, including deductions, entity structures, retirement planning, and more, catering to diverse tax planning needs.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.