Let’s look deeply at “How Long Does Clover Take To Verify A Debit Card?” The rise in popularity of cash advance applications is good news for those who would otherwise rely on short-term solutions like payday loans.

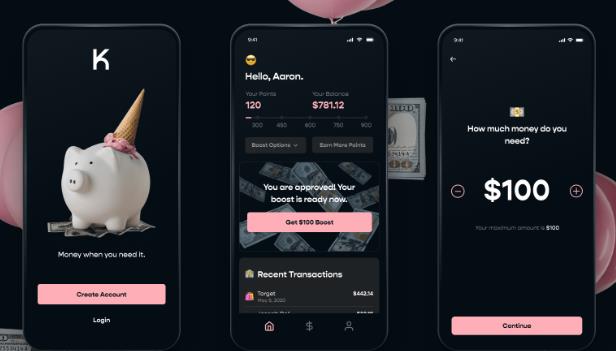

If you need extra money until your next payday, a cash advance app like Klover may be a decent, short-term answer.

How Long Does Clover Take To Verify A Debit Card?

Debit cards may take up to three business days to be securely verified. Lets see how it actually works below:

What You Should Know About Klover’s Data Use?

By assisting its partners in evaluating the success of their marketing initiatives and conducting market research, Klover makes money.

This information may include phone usage, app use, survey responses, and bank account activities. According to the business, it never divulges personally identifiable information about its clients.

Users must provide Klover their permission to view the data; they can revoke that permission by deactivating their account.

How Do Klover Cash Loans operate?

According to the firm, Klover advancements function as follows.

- Make an account and download the app.

- Give the details of your debit card and bank account.

The app will display your advance limit if your bank account information indicates you qualify for an advance. If not, you can still earn points by completing surveys, uploading receipts, or picking an offer from the app’s offer page.

The Klover app will ask whether you want to pay a charge to receive funds promptly or leave an optional tip when requesting an advance. If you choose not to accept the fee, your payments will arrive in three business days.

The app will remove money for eligibility-based advances on your subsequent payday. The app deductions your account seven days after the request for points-based advances.

How Much Can I Get A Loan From Klover?

The typical borrowing limit for cash advance applications is between $100 and $500. The official Klover website states that customers may borrow up to $200.

Klover likewise employs a points system to raise the limit despite the beginning limit being lower than some of the other cash advance applications. As soon as customers sign up, points accumulate and keep growing as they use the app frequently.

Earning points primarily involves:

- Scan any receipts for purchases made with the account’s connected debit card. There are up to 20 points for each receipt.

- To gain 50 points, use the app to track your purchasing patterns.

- Watch the video advertisements. Each advertisement adds a few points and lasts between 10 and 30 seconds.

- Save $100 in a month to earn 200 more points.

- Earn some points by taking surveys.

- Suggest Klover to a friend. If they download and register for the app (and are eligible), 600 points will be added to their account.

The user’s account can receive a “boost” or additional cash by exchanging points for that. The potential increase in the borrowing limit is based on the number of points.

$10 is equal to 10 points. For instance, 300 points add $10 more, whereas 900 points add $30 more.

How Long Does It Take Klover To Send Money?

Klover provides both the free basic ACH service and the Immediate Debit option. Fund requests are normally completed using the basic option within two business days.

The following day, the money is put into the user’s associated checking account. This service is provided without charge.

However, the Immediate Debit option speeds up the transfer of payments and gives you quick access to your money. This option was just made available by Klover to customers in financial trouble.

The money will be deposited into the customer’s account the same day they choose this option, even if the request was made on the weekend.

This service has a charge that ranges from $1.99 to $14.98. Processing the request for funds may take longer or shorter for some banking institutions.

How Does Klover Generate Revenue?

Klover does not get gratuities, unlike some contemporary financial services, such as cash advance apps like Earnin—the app, unlike other new goods, primarily profits off the data of its users.

A consumer opts into a document known as a Truth in Data agreement when they download the Klover app. This agreement states that user data would be used for advertising and anonymous market research.

To display consumers’ relevant adverts, Klover collects data from anonymous users and enters into agreements with partners or affiliates. The consumers can then watch the same advertisements to earn more points and receive future enhancements.

The advertising money is then divided by Klover. Meanwhile, Klover’s business partners gain from the crucial market research. No data that would allow its partners to identify the users is sold or shared by Klover.

How Much Does Klover Charge?

Your short-term loan from Klover has no fees or interest charges. However, there is a $2.49 monthly membership fee. Klover provides the following notice on their website:

You are not entitled to boosts with a Klover membership. Instead, you can access our financial tools, bonus points, credit monitoring, and giveaways through our membership program.

What Is A Klover Boost?

What Klover refers to as a “boost” is a “cash advance.” Boosts don’t come with extra interest or secret costs. Customers ask for a boost when they need money and promise to pay it back when they earn their next salary.

The consumer must accrue points to increase the maximum boost.

What’s The Operation Of The Klover App?

The process is straightforward. The customer first registers on the Klover app by providing basic information and linking their checking account. The user’s information and account are validated during the 24- to 48-hour waiting period following account setup.

The user may then ask for a cash advance or “boost.” Although it can be accelerated to arrive on the same day, it typically takes 1 or 2 business days for the money to be put into the account.

While the accelerated direct deposit is available for a modest cost, the ordinary version is free.

Once the funds are in the borrower’s account, they may use them however they see fit. The software automatically deducts the amount borrowed from the user’s paycheck the following payday.

The application withdraws the same amount borrowed because there are no additional fees. For instance, if someone withdraws $50, the app will likewise withdraw $50.

Is Klover A Real Company?

Though only a few years old, the FinTech business known as Klover Holdings has a reliable app and secure financial service. Any short-term financial advance, however, carries some dangers.

Many consumers find that taking out a cash advance increases their risk of failing on other debts, such as their credit card or making late payments.

A cash advance also reduces the money available when receiving the following paycheck. This might make overdraft costs more likely. This is so that Klover automatically withdraws the money from the account when a payment is due.

Only obtain a cash advance in an emergency or if you have a strategy for making up the shortfall when your next paycheck arrives to minimize this danger.

Does Chime Support Klover?

Yes, Klover and Chime work together. Thanks to this mobile banking software, borrowers can have early access to money they’ve previously earned before payday.

Chime has many advantages, but finding cash advance apps that work with it can occasionally be challenging to find cash advance apps that work with it.

What Are The Requirements To Borrow Through Klover?

Although using Klover to borrow money is rather simple, customers must fulfill a few requirements before they can sign up and complete their first transaction. The consumer must show proof of the following to qualify:

- A current, operational bank account that is at least 90 days old.

- A minimum of three continuous direct deposits were made over the previous two months into the account.

- Continuous work for the same employer. The same employer must be used for all direct deposits. Klover does not accept paper checks or deposits made through Venmo, PayPal, Cash App, or ATMs.

- The bank statement’s paycheck and earlier paychecks contain identical information. Any errors or misspellings could result in rejection.

- A surplus in your checking account.

Deposits are made into the account on a weekly or biweekly basis. Deposits made on a monthly or semi-monthly basis won’t be accepted. Regular payments are likely to be declined.

Conclusion

To conclude, How Long Does Clover Take To Verify A Debit Card? klover takes three days to verify the debit card. Other apps can’t compare to Klover’s underwriting, which is superior.

Before approving a user for an advance, the app rigorously verifies that they have regular income by checking at least three months of their bank account history.

Those who fall short of the requirements can still receive a lesser advance by accruing points. If you refrain from participating in the rewards program, the maximum $200 advance is even lower than the average for cash advance applications.

Despite not requiring any fees, the app’s fast-funding price, which may be up to $20.78, is greater than its rivals, who often give larger advances.

Even though the program claims that the advances are kept reasonable by leveraging data from your financial and mobile device usage, you can still spend more with Klover.

Frequently Asked Questions

How often does Klover update?

Processing and posting ACH payments may take up to three business days.

Which debit cards are compatible with Cash App?

Cradit and Debit cards from American Express, MasterCard, Visa, and Discover are accepted by Cash Application. The majority of prepaid cards are also used. PayPal, business debit cards, and ATM cards are not accepted.

What app allows you to borrow $250 immediately?

Brigit’s Express Delivery allows you to get up to $250 in minutes for a nominal price; however, if you wait two to three business days, there is no fee. You can pick the due date for repayment and ask for a payment extension. Additionally, Brigit provides a credit-building program.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.