Venmo, a popular mobile payment service, has revolutionized the way we manage peer-to-peer transactions. A common question many users have is: How Does Venmo Appear On Bank Statement? This is crucial for tracking expenses, managing finances, or simply understanding your financial footprint.

Key Takeaways

- Venmo transactions typically show up as ‘VENMO- PAYMENT’, ‘VENMO- CASHOUT’, or a similar variant on bank statements.

- The description on the statement might include the username of the sender or recipient.

- Understanding how these transactions are listed helps in better financial management and fraud detection.

How Does Venmo Appear On Bank Statement?

Venmo transactions typically appear on bank statements with descriptors like “VENMO- PAYMENT,” “VENMO- CASHOUT,” or a similar variation, often including the username of the sender or recipient.

Venmo Transactions: How They Reflect on Your Bank Statement?

When you use Venmo for transactions, the way these appear on your bank statement can vary based on the nature of the transaction.

Payments Made Through Venmo

When you make a payment through Venmo, it often appears as ‘VENMO- PAYMENT’ followed by the username of the recipient. This format helps in easily identifying to whom the payment was made to.

Receiving Money

When you receive money via Venmo, it might show up as ‘VENMO- CASHOUT’ if you transfer it to your bank account. This label indicates a transfer from Venmo to your bank.

Instant Transfers and Standard Transfers

Venmo offers two types of bank transfers – Instant and Standard. Instant Transfers usually appear with a distinct label for quicker identification.

The Variability in Venmo Transaction Descriptions

Venmo transactions can vary in their description based on several factors, including the bank you use and the transaction type.

Dependence on Bank Policies

Different banks may have distinct ways of displaying these transactions. It’s essential to consult with your bank for the specific format they use.

Transaction Types

The transaction type (payment, request, or transfer) can alter how Venmo appears on your bank statement. Each type has a unique identifier.

Venmo Statement Entries: A Closer Look

Understanding the specifics of Venmo entries on bank statements can aid in better financial tracking and fraud prevention.

Analyzing Transaction Descriptions

Pay close attention to the details in the transaction description. This can include the date, amount, and recipient’s username.

Fraud Detection

Recognizing the standard format of Venmo transactions on your bank statement can help in quickly identifying any fraudulent activities.

Integration of Venmo with Bank Statements: A User’s Perspective

The integration of Venmo transactions into bank statements has implications for user experience and financial management.

User Experience

The way Venmo transactions are listed can impact how users track and manage their finances. A clear and consistent format is essential for ease of use.

Financial Management

For users actively managing their budgets or tracking expenses, understanding Venmo entries is crucial. It aids in accurate financial planning and record-keeping.

Venmo and Financial Transparency: What You Need to Know

Financial transparency is vital in the digital age. Venmo’s role in this reflected in bank statements, is significant.

Ensuring Accurate Financial Records

Accurate reflection of Venmo transactions in bank statements is key to maintaining precise financial records.

The Role of Digital Payments in Financial Clarity

Digital payments, including Venmo, play a significant role in contemporary financial management, making understanding their representation in bank statements vital.

Differentiating Between Personal and Business Transactions on Venmo

When it comes to Venmo transactions, distinguishing between personal and business transactions is crucial for accurate financial record-keeping.

Personal Transactions

Personal transactions on Venmo, when transferred to a bank account, typically appear in a standard format. These are usually marked as ‘VENMO-PAYMENT’ or similar descriptors, making them identifiable for personal budgeting and expense tracking.

Business Transactions

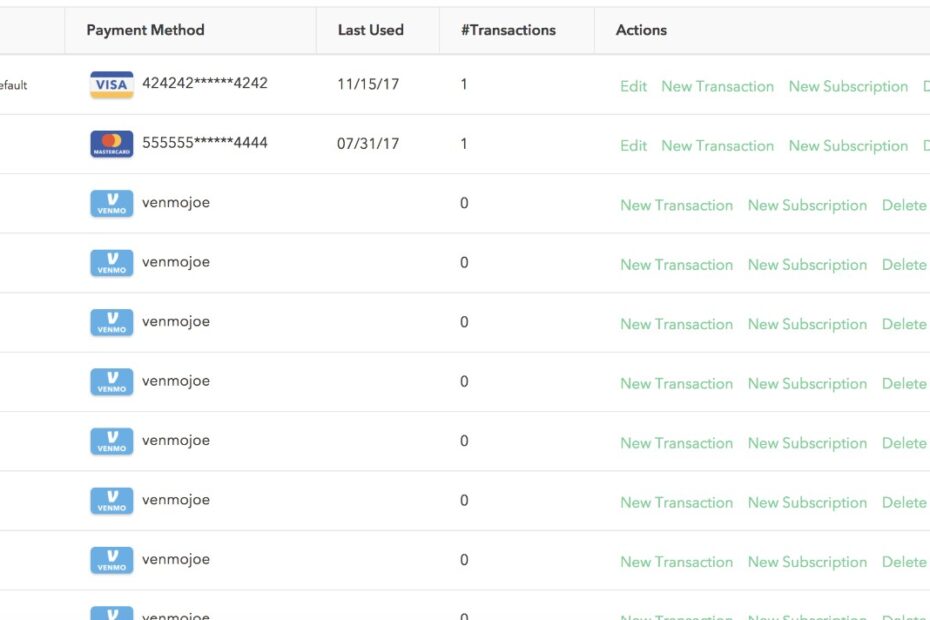

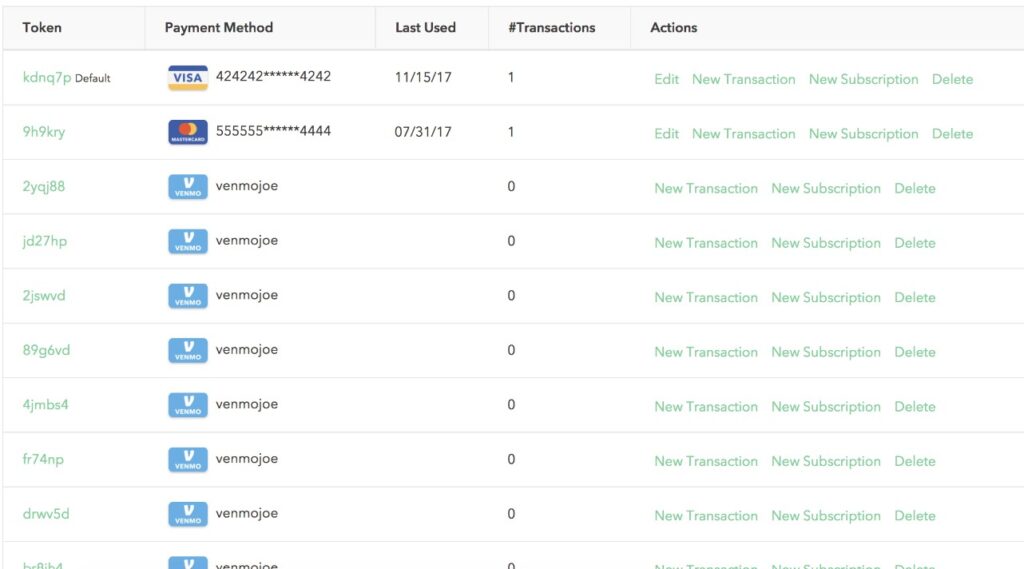

For Venmo business accounts, transactions might be listed differently on bank statements. They often include an identifier that sets them apart from personal transactions, aiding business owners in segregating their professional expenses from personal ones.

Impact of Transaction Amounts on Statement Descriptions

The amount involved in a Venmo transaction can sometimes influence how it is represented on your bank statement.

Small Transactions

For smaller transactions, banks might aggregate these under a single statement line if multiple such transactions occur within a short period. This could be for ease of representation and to avoid cluttering the statement.

Larger Transactions

Larger transactions typically get individual entries on the statement. This is crucial for better visibility and tracking, especially for significant transfers or payments.

Venmo Statements and Tax Reporting: What to Consider

For both individuals and businesses, how Venmo transactions appear on bank statements can be vital for tax purposes.

Individual Tax Considerations

Individuals using Venmo should know how to identify these transactions for personal tax reporting, especially if they involve deductible expenses or income reporting.

Business Tax Considerations

Businesses must accurately track and report Venmo transactions for tax purposes. Understanding how these transactions are listed can simplify tax preparation and ensure compliance.

Venmo Security Features and Bank Statements

Security is paramount in digital transactions. How Venmo transactions are listed on bank statements plays a role in security measures.

Transaction Verification

Users can use their bank statements to verify the authenticity of Venmo transactions. This is a crucial step in ensuring that all transactions are legitimate and authorized.

Fraud Detection

Any anomalies in how Venmo transactions appear on bank statements can be early indicators of fraudulent activity. Users should be vigilant in reviewing their statements regularly.

Improving Financial Literacy with Venmo Transactions

Understanding the appearance of Venmo transactions on bank statements contributes to overall financial literacy.

Budgeting and Expense Tracking

Recognizing and categorizing Venmo transactions can aid users in better budgeting and expense tracking, leading to improved financial habits.

Financial Decision-Making

With a clear understanding of their transaction history through bank statements, Venmo users can make more informed financial decisions.

How Do I Hide Venmo Transactions On My Bank Statement?

Hiding Venmo transactions on a bank statement isn’t directly possible because once a transaction is completed and processed by Venmo, it is automatically recorded in your bank’s transaction history.

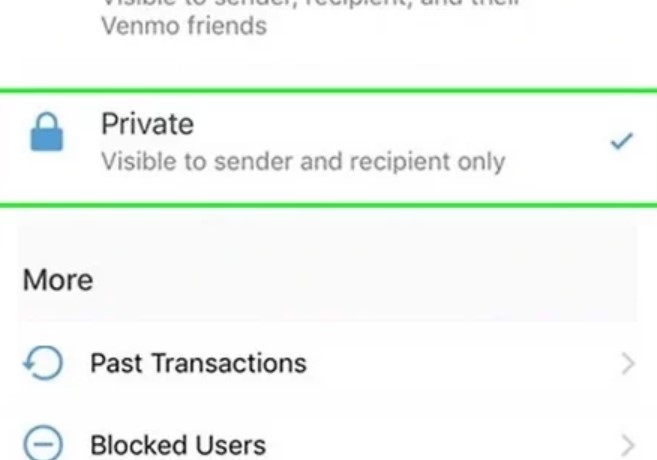

Bank statements are legal documents that reflect all financial activities in your account, and altering them is neither feasible nor legal. However, you can maintain privacy in your Venmo activity by adjusting the privacy settings within the Venmo app itself, ensuring that your transactions are not publicly visible within the Venmo network.

It’s important to remember that these settings will not affect how transactions appear on your bank statement. For concerns about privacy or statement records, it’s advisable to consult with your bank or a financial advisor.

How Does Venmo Notify You Of A Payment?

Venmo notifies users of payments through in-app notifications, emails, and/or text messages, depending on the user’s notification settings. When you receive a payment on Venmo, the app sends an instant notification to your mobile device if you have the app installed and notifications enabled.

Additionally, Venmo can send email notifications for each transaction. Users can customize their notification preferences in the app settings to choose how they receive these alerts. This ensures that users are promptly informed about their account activities, enhancing the app’s usability and security.

Does Venmo Show Who You Paid On Your Bank Statement?

Your bank statement does not show detailed information about who you paid via Venmo. Typically, a Venmo transaction on a bank statement will include a standard descriptor like ‘VENMO-PAYMENT’ or ‘VENMO- CASHOUT’, along with the amount and date of the transaction.

It does not specify the recipient’s name or other details. For detailed information about the recipient of a Venmo payment, users should refer to their Venmo transaction history within the app. This approach helps maintain a balance between privacy and the need for transactional transparency in financial records.

Conclusion

In conclusion, understanding how Venmo appears on your bank statement is essential for effective financial management. Venmo transactions typically appear with clear labels like ‘VENMO- PAYMENT’ or ‘VENMO- CASHOUT’, facilitating easy tracking and budgeting. Recognizing these transactions helps in maintaining accurate financial records and detecting any potential fraud.

People Also Ask

Is There a Limit to the Number of Venmo Transactions Shown on a Bank Statement?

There is no set limit to the number of Venmo transactions that can appear on a bank statement. However, banks may aggregate multiple small transactions for simplicity.

How Are Venmo Instant Transfers Marked on Bank Statements?

Venmo Instant Transfers are often marked with a specific identifier like ‘INSTANT’ on your bank statement. This distinguishes them from standard transfers, which take longer to process.

How Can I Identify Potential Fraudulent Venmo Transactions on My Bank Statement?

Regularly review your bank statement for any Venmo transactions that you don’t recognize. If you spot a suspicious transaction, cross-reference it with your Venmo app and report any discrepancies to both Venmo and your bank immediately.

What Should I Do If a Venmo Transaction Doesn’t Appear on My Bank Statement?

If a Venmo transaction doesn’t appear on your bank statement, first verify the transaction in your Venmo app. If it’s confirmed, wait a few business days. If it still doesn’t show up, contact your bank and Venmo for support.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.