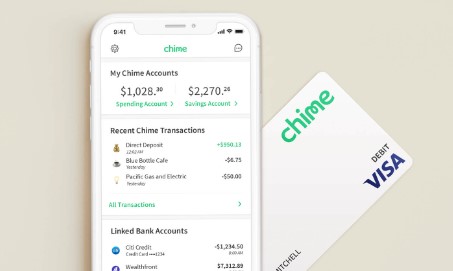

Don’t worry! It’s understandable How Do I Add Money To My Chime Account Without The Card? Chime has so many users, given its low costs, speedy transfer times, extensive ATM network, and Chime Card. However, their clients ponder how they might load funds onto the Chime Card.

There are numerous options for loading a Chime Card. Chime avoids this problem by collaborating with a huge network of typical pharmacies and grocery stores for you to deposit at.

In contrast, some online-only banks need help to provide their users with a place to deposit cash.

Additionally, you can change your payday direct deposits into your Chime account, avoiding needing to visit a bank with your paycheck. You can always take a picture of your checks if you don’t want your employer to deposit them for you.

Chime provides a wide range of banking services, but they also function as a platform for money transfers, making it simple to deposit money into your account.

Friends can send you money for free, and you can send money back.

Lastly, transferring money from a connected bank account is one of the simplest ways to deposit money into your Chime account. Free, secure, safe transfers can enter your Chime account within a few business days after leaving your bank’s checking account.

How Do I Add Money To My Chime Account Without The Card?

With the help of partners in cash deposits, at more than 90,000 store locations, you can put cash into your Chime Checking Account. Ask the cashier to put money in your Chime Checking Account right away.

How To Put Money On Chime Card By Depositing Cash?

Most fintech companies and online banks encounter issues when customers wish to deposit cash. They need the physical branch network that traditional banks do because they are Internet banks.

They wouldn’t be able to serve their Florida consumers even if they had a branch in New York.

Fintech businesses solve this issue by collaborating with businesses with physical locations rather than opening their own.

To provide their consumers with a wide range of locations that will accept their cash, Chime partners with Walgreens, 7-Eleven, Dollar General, and more.

You have many possibilities if you use Chime and have any cash you want to load onto your Chime Card. Many businesses will accept your cash deposit, but only one will do so without a fee.

Walgreens is the only retailer Chime partners with to provide its consumers with free cash deposits.

Your deposit will still be accepted at CVS, Family Dollar, and other shops in Chime’s network, but they might charge you separately for doing so.

Chime offers a map in their app if you’re looking for one of these physical businesses and want to make sure they accept Chime deposits. Open the Chime app and navigate to the Move Money tab at the bottom of the screen to find it.

Chime will then request authorization before entering your location. If you permit them to use it, they’ll quickly bring up local businesses that accept Chime deposits. If not, they’ll set your map to a default location; after that, you can manually enter your position.

My Chime account transported me to San Francisco, where Chime is based, and displayed several CVS and Walgreens locations where I could deposit cash using Chime.

The list included every store’s phone number, address, and closing time, in addition to the distance between my location and each of them. You can even get driving instructions from Chime.

The deposit fees are affordable; according to my Chime app, a deposit at CVS would cost $4.95. Although $4.95 isn’t the most costly price, it is expensive enough that I’m thinking of making a free deposit at Walgreens in its place.

There won’t only be a button attached to your account when you visit Walgreens to make a Chime cash deposit. You must inform the cashier that you wish to deposit money into your Chime account and carry a Chime card.

The cashier can link your deposit to your account after you swipe your Chime card in the reader. Give the money you want to deposit into your account a quick swipe of your card. Keep in mind that each account has a deposit cap.

Customers of Chime are only permitted to deposit a certain amount of cash daily and monthly. You can make up to five deposits per day of cash into your Chime account. Cash deposits are limited to a daily total of $1,000 and a monthly maximum of $10,000.

How To Put Money On Chime Card Through Depositing Paper Checks?

Chime isn’t a traditional bank like Wells Fargo or Chase Bank, but they are aware of some advantages of doing your banking in person. For instance, dealing with checks through an online bank can be challenging because their validity needs to be confirmed.

By enabling consumers to scan both the front and the back of their checks into the Chime app, Chime combats this. Before authorizing the deposit and crediting your account, Chime examines the check and the numeral and numeric dollar values.

Launching the Chime app allows you to deposit a paper check into your Chime account. However, there are some restrictions when depositing checks using Chime.

Chime has $5,000 for U.S. treasury checks and $2,000 for non-U.S. treasury checks for mobile deposits. You may also deposit up to ten checks each month. The total monthly cap for mobile check deposits through Chime is $10,000.

Regarding deposit times, Chime needs at least 5 business days to hold the check, process it, and examine it before releasing it to your account. They take their time to ensure the check is valid and the money doesn’t bounce.

The long wait time may put potential users off, but most mobile check deposits are handled by Simin a d regardless of the financial institution difference.

Even after utilizing Chase’s mobile deposit service for over five years, my checks still take at least 2-3 business days to complete, but I’ve never had a bounced check.

You should be aware that Chime initially wants you to set up payroll direct deposit before you can use the mobile deposit feature.

You can deposit other checks once you’ve electronically received a few of your payroll checks through Chime. As you must wait for two to three payroll cycles to certify the link between your account and your payroll, this process could take some time.

After a short delay, however, you can deposit whatever type of check you desire into Chime by simply snapping a picture.

Using the mobile deposit capability, you can manually enter the check’s dollar amount and snap images of the front and back.

If the photographs you took need to be clearer, Chime will let you know. You can retake them if they are not. You can use the money everywhere Chime is accepted after Chime releases it to your Chime card after about 5 business days.

How To Put Money On Chime Card By Transferring Money From Your Bank Account?

This could be the simplest method of transferring funds into and out of Chime. If you have a related bank account, you can add money to Chime or take money from the app, such as a checking account with Bank of America.

Any bank account-related transactions made through Chime are processed in three working days. Up to five business days may pass between the first two as Chime attempts to confirm their relationship with your account.

It’s simple to transfer money, and you can do it from the Chime app both in and out of Chime. To transfer money from other banks, open the Chime app, navigate to the Move Money tab near the bottom of the screen, and click on it.

If you still need to, Chime will ask you to link an external account when you click that button.

Chime connects bank accounts to its platform using Plaid. If you need to become more familiar, One of the largest financial services companies, Plaid, facilitates communication between companies like Chime and banks like Chase.

Because Plaid is a well-known company used by Cash App, Venmo, and other services, I say like in both cases. You can connect your accounts with Plaid by logging onto your bank’s online service.

You can manually enter your account information if you can’t or don’t want to log into your bank’s online platform.

Your bank account number, routing number, and the name of the bank that manages your account will all be requested by Plaid and Chime. They might send a few test deposits and withdrawals to ensure they have the correct account.

A few deposits for less than a dollar, generally just a few cents, can be used as trial deposits. Chime will withdraw the tiny deposits from your account when they have been made, ensuring they have the proper one.

You can use it anytime to add money to your Chime card after the trial deposits have been made and your checking account has been successfully linked with Chime. Remember that Chime requires three to five working days to execute bank transfers.

Conclusion

I hope you learn the process of adding money to chime account because If you don’t have a bank account, don’t want to utilize direct deposit, or don’t want to use mobile check deposit, a quick and handy option is to add money to your Chime card at a third-party merchant.

You can accomplish this by going to a participating store and paying there with cash or a debit card. Your Chime account will get the money immediately.

Frequently Asked Questions

Can I add money to Chime with another card?

All you need to do to add at least $200 instantly is link an external bank account and add your debit card information.

How do I add money to my Chime card for free?

Over 8,500 Walgreens and Duane Reade, stores accept cash deposits for free into Chime Checking Accounts.

Can I count money to my Chime card online?

Launch the Chime app on your phone and sign into your account. Select Transfers under Move Money. Next, input your bank account’s login and password. You may now add funds to your Chime card.

Can you transfer funds to my Chime account?

Pay to Send and receive money to your Chime account using anyone’s name, $ChimeSign, phone number, or email address. Even those who still need to be Chime members can get paid.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.