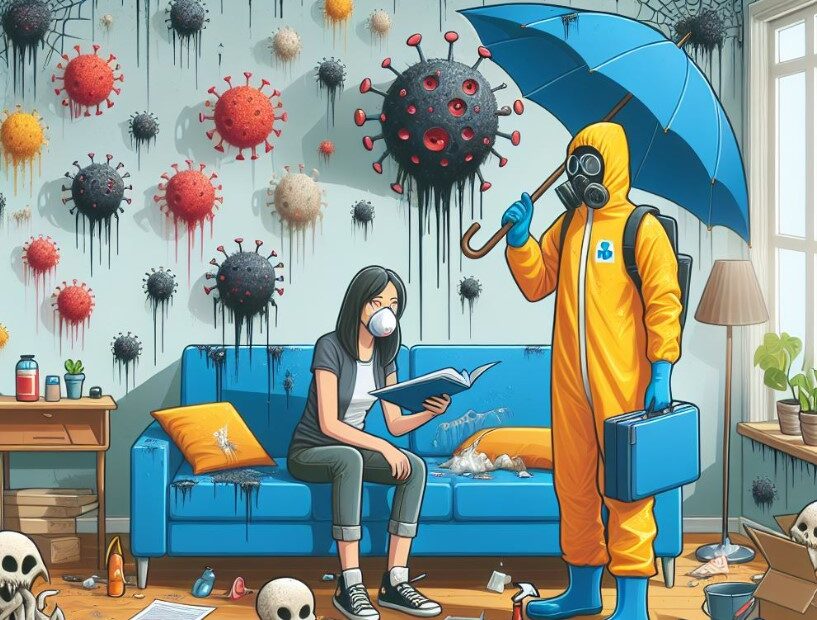

This article aims to provide information on Does Renters Insurance Cover Biohazard Cleanup? Renters insurance is a critical tool for protecting tenants from unexpected financial burdens. However, when it comes to specific scenarios like biohazard cleanup, understanding the intricacies of your policy is vital. In this comprehensive guide, we explore the nuances of renters insurance and its applicability to biohazard situations.

Key Takeaways

- Renters insurance may cover biohazard cleanup under certain conditions.

- Coverage varies by policy and insurance company.

- Biohazard cleanup can be expensive, so understanding your policy is essential.

- Communication with your insurance provider is crucial for clarification on coverage specifics.

- Additional riders or policies might be necessary for comprehensive biohazard coverage.

Does Renters Insurance Cover Biohazard Cleanup?

Renters insurance typically includes coverage for personal property damage, liability, and additional living expenses. However, whether it covers biohazard cleanup depends on the source and nature of the biohazard incident. Generally, if the biohazard is a result of a covered peril, such as a fire or vandalism, the cleanup would likely be covered.

Policy Specifics and Limitations

- Coverage for biohazard cleanup varies significantly between policies.

- Policies often have specific exclusions and limitations regarding biohazard incidents.

Factors Influencing Coverage

- The source of the biohazard (e.g., crime scene, mold, chemical spill) plays a critical role in determining coverage.

- Policy limits may affect the extent of coverage for biohazard cleanup.

Understanding Your Policy

It is essential to thoroughly understand your renter’s insurance policy to know what is and isn’t covered. Biohazard cleanup can be a complex and costly process, making it vital to ensure adequate coverage.

Reviewing Policy Details

- Review your policy document carefully to understand the specifics.

- Look for clauses or exclusions related to biohazard incidents.

Consulting with Insurance Providers

- Communicate directly with your insurance provider for clarity.

- Consider seeking professional advice if you have doubts about your coverage.

Additional Coverage Options

In some cases, standard renters insurance policies may not cover biohazard cleanup, or the coverage may be insufficient. Exploring additional coverage options can provide more comprehensive protection.

Riders and Endorsements

- Riders or endorsements can be added to enhance biohazard coverage.

- Understand the costs and benefits of additional coverage.

Separate Biohazard Insurance

- Separate biohazard insurance policies are available for more extensive coverage.

- Assess your individual needs and risks to determine if separate insurance is necessary.

Cost Considerations

The cost of biohazard cleanup can be significant, making it important to have adequate insurance coverage. Understanding these costs helps in evaluating the sufficiency of your insurance policy.

Factors Affecting Cleanup Costs

- The extent and nature of the biohazard impact cleanup costs.

- Location and accessibility can influence the cost of cleanup services.

Insurance Policy Limits

- Consider the policy limits and how they align with potential cleanup costs.

- Evaluate if your current coverage is sufficient to cover these expenses.

Scenarios and Examples

Examining specific scenarios can provide a clearer understanding of how renters insurance applies to biohazard cleanup. These examples illustrate common situations and coverage implications.

Scenario Analysis

- Crime scene cleanup in a rented property: Is it covered?

- Mold or mildew resulting from a covered peril: Coverage considerations.

Real-life Case Studies

- Analyzing past claims and outcomes related to biohazard cleanup.

- Lessons learned from these case studies.

Claim Process for Biohazard Cleanup

Navigating the claim process for biohazard cleanup under renters insurance can be intricate. Timely and accurate reporting plays a crucial role in ensuring coverage.

Initial Steps and Reporting

- Immediate notification to the insurance provider is essential.

- Documenting the extent of the biohazard through photos and detailed descriptions aids in substantiating your claim.

Assessment and Approval

- Insurance companies typically conduct an assessment to verify the claim.

- Understanding the timeline and requirements for claim approval is vital to facilitate a smooth process.

Role of Professional Cleanup Services

Professional biohazard cleanup services are often necessary for safe and effective remediation. Renters insurance may cover the costs of these services, depending on the policy.

Importance of Professional Services

- Biohazard situations often require specialized cleaning techniques and equipment.

- Professional services ensure that the cleanup is done safely and in compliance with health regulations.

Coverage for Professional Services

- Review if your policy includes or excludes coverage for professional cleanup services.

- In some cases, insurers have preferred providers or may require multiple estimates.

Policy Nuances and Exclusions

Understanding the fine print of your renter’s insurance policy is crucial, especially the nuances and exclusions that might affect biohazard cleanup coverage.

Common Exclusions

- Certain biohazard situations, like natural disasters or terrorism, might be excluded.

- Policies often have specific clauses regarding deliberate acts or negligence.

Reading Between the Lines

- Pay attention to the wording of your policy to understand its implications.

- Seek clarification on ambiguous terms or conditions that might affect coverage.

Impact of Renters Insurance on Landlord-Tenant Relations

The presence of renters insurance can significantly impact the dynamics between landlords and tenants, especially in the context of biohazard incidents.

Tenant Responsibilities

- Tenants are often responsible for reporting biohazard issues promptly to landlords.

- Ensuring compliance with lease agreements regarding damage and insurance is key.

Landlord Involvement

- Landlords may need to be involved in the claim process, especially if structural damage is involved.

- Understanding the landlord’s insurance coverage and how it interacts with renters insurance is beneficial.

Updates and Renewals of Renters Insurance

Regularly updating and renewing your renter’s insurance policy ensures that your coverage remains relevant and comprehensive.

Keeping Policies Current

- Update your policy to reflect any changes in living circumstances or property value.

- Regular reviews ensure that your coverage is adequate for current needs.

Renewal Considerations

- At renewal, evaluate if your current policy still meets your requirements.

- Consider market changes or new offerings that might provide better coverage or rates.

Conclusion

In conclusion, whether renters insurance covers biohazard cleanup depends on the specific policy, the nature of the biohazard incident, and various other factors. It’s essential to understand your policy thoroughly, consider additional coverage options if necessary, and be aware of the potential costs involved in biohazard cleanup.

Always communicate with your insurance provider for the most accurate and up-to-date information. Remember, being prepared and informed is your best defense against unexpected financial burdens.

People Also Ask

Are there additional costs or deductibles involved in biohazard cleanup claims?

Yes, like other claims, biohazard cleanup claims are subject to your policy’s deductible. You’ll need to pay this amount before your insurance coverage kicks in.

If a crime occurs in my rented property, will renters insurance cover the biohazard cleanup?

In many cases, renters insurance does cover cleanup after a crime, such as a break-in or vandalism. However, coverage specifics can vary, so check your policy or speak with your insurer.

Coverage in shared living spaces can be complex. Generally, your personal renter’s insurance covers your liability and belongings. Each tenant needs to have their coverage.

What should I do if my renters insurance denies coverage for a biohazard cleanup?

If your claim is denied, review the reason for denial and your policy terms. You can appeal the decision or consult with an insurance expert or attorney for further advice.

Can I choose my own biohazard cleanup company, or must I use one recommended by my insurance?

This depends on your policy. Some insurers allow you to choose your cleanup company, while others may require you to use their approved providers. Always confirm with your insurer before hiring a service.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.