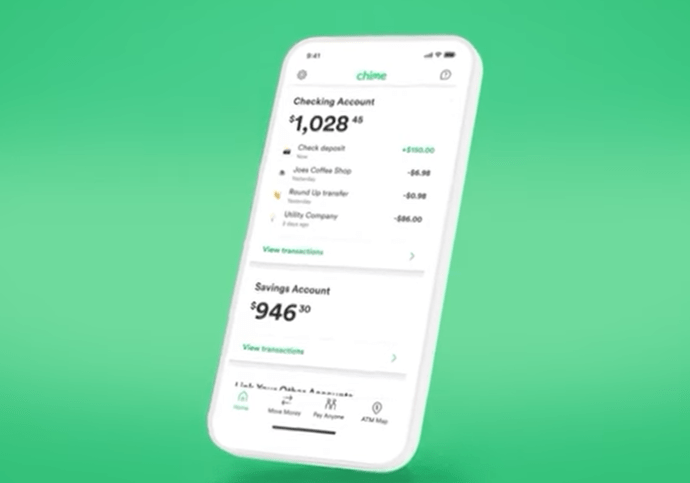

That paycheck is your hard-earned money, frequently arriving just in time. Use it to pay expenses, boost your savings, or treat yourself to something lovely. Is the only thing superior to payday? You can receive payment as much as two days early.

With Chime early direct deposit, you have two days’ worth of access to your paycheck. How does the Get Paid Early function on Chime operate? Here is everything you need to know about Is it possible for chime really pay early?

Does Chime really pay early?

Direct deposit is done automatically. They can provide you with access to your paycheck up to two days ahead of some conventional banks. Let’s check up the process of setting up chime account to get paid early:

How to Set up Get Paid Early With Chime?

Once you’ve configured your Chime account for direct deposit, being paid early is simple. This is how:

- Open a Chime Checking Account

You must first create a Chime Checking Account. Fear not—it only takes a couple of minutes! Have a Chime Checking Account already? Open the Chime app on your phone to move on to the next step.

- Choose a direct deposit option

You must set up direct deposit to access the Get Paid Early app features from Chime. There are a few quick methods to enroll with us:

- In the app, Chime: Move your direct deposit by selecting it under Move Money in the Chime mobile app. To set up direct deposit, you can copy your routing and account details here and give them directly to your employer or payroll service.

- On the web, Authenticated on your laptop? To discover your account information to give to your employer, visit www.chime.com, log into your account, and select Move Money.

- Via email: In the app, select the Get Completed form, and we’ll send your employer a completed direct deposit form in an email.

- Get your paycheck sooner

Once you’ve signed up for direct deposit, everything is set. Even if your paycheck arrives sooner than the specified payment date, we’ll transfer it into your account as soon as we get it from your company.

Can I Receive Supplemental Security Income (SSI) up to Two Days Early?

Yes. Let me remind you that we never keep deposits. As soon as we receive the deposit from the payer, we quickly transfer your funds into your checking account.

As soon as your funds are available, we’ll notify you by email and push notification on your phone.

If you don’t notice your deposit, it’s likely that your benefits provider still needs to send it or that it’s in transit. For more details, speak with your provider.

The time the payer submits the payment file determines when funds will be available for early access via direct deposit.

The day the payment file is received, which could be up to two days before the planned payment date, is typically when we make this money available.

Chime A single deposit of $200 or more in eligible direct deposits to the Chime Checking Account each month is required for SpotMe®, an optional feature with no fees.

All eligible members will initially be permitted to overdraw their accounts by a maximum of $20 for debit card purchases and cash withdrawals.

Still, Depending on their Chime Account history, customers can later qualify for a greater limit of up to $200 or more, the frequency and size of their direct deposits, spending patterns, and other risk-based variables.

The Chime mobile app will show you what your limit is. Any modifications to your limit will be communicated to you in advance.

Depending on Chime’s judgment, your restriction can vary at any time. Although no overdraft fees exist, ATM transactions may be subject to out-of-network or third-party costs.

Transactions made through ACH transfers: SpotMe does not cover Pay Anyone transfers or Chime Checkbook transactions. Look at the terms and conditions.

You must have had a single $200 or more qualifying direct deposit into your checking account to be eligible to apply for Credit Builder.

Your employer, a payroll service, a payer for the gig economy, or a payment of benefits must make the qualifying direct deposit using either an Original Credit Transaction (OCT) or an Automated Clearing House (ACH) deposit.

These are not qualifying direct deposits: bank ACH transfers, Pay Friends transfers, verification or trial deposits from financial institutions, peer-to-peer transfers through services like PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits like tax refunds and similar transactions, and any deposit that Chime determines is not a qualifying direct deposit.

Conclusion

Yes! Chime really pays early. The online banking system Chime is well known for its promise to give users early access to direct deposits.

However, depending on several variables, this feature’s efficacy may vary. The timing and policies of the sender’s bank and the ACH (Automated Clearing House) processing delays will determine whether Chime can make an early payment.

Although many chime users claim to have received their direct deposits up to two days sooner than with conventional banks, this is only a guarantee for some people or circumstances.

The motivation behind Chime’s dedication to early access is to provide customers with an advantageous service, but the precise date of fund availability may vary.

Users should become aware of Chime’s policies, monitor the time it takes for deposits to be processed, and retain reasonable expectations for early payout.

FAQs

Does Chime Really Get Paid 2 Days Early?

The time the payer submits the payment file determines when funds will be available for early access via direct deposit. The day the payment file is received, which could be up to two days before the planned payment date, is typically when we make this money available.

How Quickly Can You Get Money From Chime?

Both Chime members and non-members get fast access to their money! Non-members have up to 14 days to claim their money by providing a working debit card.

Why didn’t Chime pay me early?

Like most financial institutions, our bank partners only handle payments during the week (Monday through Friday). Additionally, Chime honors all bank and government holidays. Check the calendar to determine if a holiday may have caused the payment to be delayed if you were anticipating receiving your paycheck early but have yet to see it posted.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.